The Cambridge Centre for Alternative Finance (CCAF) has published its first “Global RegTech Benchmarking Report,” sponsored by EY Japan. According to the research, the Regtech industry has topped $5 billion in revenue in 2018 following a five-year surge in startup activity. CCAF reports that, while Regtech is not necessarily that new, about 60% of all Regtech firms were founded and 82% had their first funding round during this five year period as interest in the sector boomed. The report says that Regtech has developed into distinct market segments.

This is not the first research by CCAF that has examined regulators’ interest in the potential of Regtech and Suptech [Supervisory Technology]. Earlier this year, CCAF reviewed this growing trend in a report by CCAF and the FinTech Working Group of the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA), published earlier this year. The latest CCAF research is said to corroborate and adds to those findings.

As of 2018, Regtech firms employed an estimated 44,000 people globally, having raised about $9.7 billion in external funding to date. The research is based on a survey of 111 Regtech firms as well as qualitative interviews with industry experts and regulators. The Benchmarking report was unveiled by CCAF Executive Director Bryan Zhang at FIN/SUM in Tokyo, the largest Fintech event in Japan.

Firms headquartered in Japan made up 4% of the survey sample and just over twice that total (9%) had operations in the country. This places Japan at the top of Regtech jurisdictions.

The report indicates that the Regtech industry is already highly international, with fewer than one-third of firms active in just one market and over a third present in five or more jurisdictions.

Nearly two-thirds of firms had a physical presence or significant market share in the UK, and nearly half have the same in the US. There are also significant Regtech activities in Australia, Canada, Singapore, Hong Kong, Japan, Luxembourg, Switzerland, Ireland, Germany, and France.

CCAF states that there is a “clear link between the surge in Regtech market entry in the years 2014 to 2018 and the amount of new regulation introduced or implemented during that time.”

According to the report, about “two thirds (66%) of the sector delivers its offerings through the cloud, with 56% of vendors employing machine learning and 43% using predictive data analytics to describe patterns or predict behaviours.”

Natural language processing, machine learning, data analytics are key to the Regtech sector. There is a demand from firms that have to report large volumes of data in standardized forms for supervisory compliance. CCAF states that offerings focused on anti-money laundering requirements or on creating data lakes for reporting purposes, are relatively common.

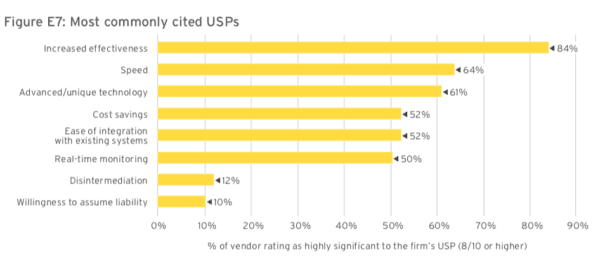

Regtech holds a strong focus on Fintechs as between 49% and 68% of firms target Fintechs. Increased effectiveness, speed, cost savings and more are all cited as firm goals.

CCAF researchers identified five distinct segments of the RegTech market. The largest by funds raised to date were the Profiling and Due Diligence and Dynamic Compliance segments, while the largest share of turnover was claimed by firms in the Reporting and Dashboards and Risk Analytics segment. A smaller Market Monitoring segment was also identified.

While the industry is growing rapidly, market participants face challenges such as complexity and long sales cycles. A handful of larger vendors have dominated most funding and commercial activity so far but a half of these firms have raised less than $1.6 million. Over 25% have accepted no external funding.

While the industry is growing rapidly, market participants face challenges such as complexity and long sales cycles. A handful of larger vendors have dominated most funding and commercial activity so far but a half of these firms have raised less than $1.6 million. Over 25% have accepted no external funding.

Zhang said that the Regtech report is building on CCAF’s previous work in benchmarking various Fintech sectors:

“… this report brings together empirical data in order to elucidate the size, growth, dynamics, and development of the Regtech sector. The report findings point to a rapidly growing and technology-enabled global industry serving an increasingly diversified customer base, yet still working to establish trust and credibility as it matures,” said Zhang.

Emmanuel Schizas, the lead researcher from CCAF on the report, said that there is a greater emphasis among Japan-based firms on fraud detection and customer identification as core use cases, particularly those powered by machine learning.

Emmanuel Schizas, the lead researcher from CCAF on the report, said that there is a greater emphasis among Japan-based firms on fraud detection and customer identification as core use cases, particularly those powered by machine learning.

“In Japan, as elsewhere, regulators seek a balance between helping the sector grow, collaborate and build public goods; and letting firms make their own commercial case for automating compliance,” explained Schizas. “It will be interesting to see how Japan’s network of Regulatory Sandboxes interacts with the RegTech sector. The level of demand for such assistance is comparable with that at the global level, where one in five firms has applied to a Sandbox.”

In the forward of the report, Keiko Ogawa, Partner and EY Japan Regtech Leader, said that EY Japan has been working with many parties in public and private sectors to create a global environment that boosts Regtech innovation.

“A variety of key players, including regulated companies, regulators, technology start-ups, and research institutions, can contribute to each other and mutually benefit, and further drive innovation in the entire society. We hope that this report will provide them with some indication of to how to realize such a Regtech ecosystem.”

CCAF notes that the report’s survey fieldwork was supported by the International RegTech Association (IRTA) and the Australia-based RegTech Association, while EY Japan and the Fintech Association of Japan helped CCAF reach more of the Japanese Regtech market.

Bruno Abriux, President of the Japan Chapter of the International RegTech Association (IRTA), described the research as an important publication which will help the IRTA deliver on their goal of supporting Regtech development.

Deborah Young, CEO, of The RegTech Association, said that evidence-based research is vital for sector growth:

“To understand the breadth, size and growth of what is now a thriving, global industry is key in setting the cornerstone for trust, efficiency, and productivity across not only financial services but all regulated industry verticals. The RegTech Association is pleased to have been able to support this global data collection exercise by CCAF and EY Japan,” Young said.

CCAF is the leading research institute covering the global Fintech industry. CCAF has published research reports on the alternative finance industry including blockchain, online capital formation, regulation, and more.