The Financial Stability Board (FSB) is out with a report on Fintech/distributed ledger technology. Entitled Decentralised Financial Technologies, the document reviews the impact of “decentralization” (IE blockchain and other forms of Fintech) on global financial stability and international regulatory environment.

The report is being delivered to G20 Finance Ministers and Central Bank Governors for their meeting in Fukuoka on 8-9 June, which includes a “High-Level Seminar on Financial Innovation.”

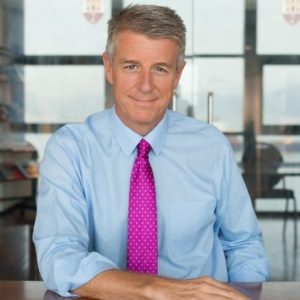

The FSB was established to coordinate the work of national financial authorities and international standard-setting bodies in order to develop the implementation of effective regulatory policy. The FSB is currently chaired by Randal K. Quarles, Vice Chairman for Supervision at the US Federal Reserve.

The FSB was established to coordinate the work of national financial authorities and international standard-setting bodies in order to develop the implementation of effective regulatory policy. The FSB is currently chaired by Randal K. Quarles, Vice Chairman for Supervision at the US Federal Reserve.

Quarles has previously advised global regulators to pursue a multi-national approach towards crypto regulation.

The document states that technology may reduce, or eliminate the need for, intermediaries. This decentralization takes on three forms: the decentralization of decision-making, risk-taking, or record-keeping.

There are already many examples emerging of decentralization including payments and settlement, capital markets, trade finance, and lending.

Current examples of financial decentralization include two specific models:

- Distributed ledger technology (DLT or blockchain) which enables the decentralization of record-keeping. It does so by removing the need for a central ledger in which to record financial transactions. Various levels of decentralisation of record-keeping are possible. These vary from “permissionless” or public systems that are open to all users, to “permissioned” or private systems where a more limited consortium of users are able to read and/or write to a ledger. This includes tokenization of assets.

- Online peer-to-peer (P2P), or user-matching, platforms allow users (e.g. creditors and borrowers) to interact directly and decentralize their risk-taking and decision making, yet avoid the sort of search costs that might otherwise be incurred in the absence of a centralized intermediary (e.g. bank or insurance company). As a consequence, lending activities may migrate away from financial intermediaries.

According to the FSB, decentralization innovation may benefit financial stability – leading to greater competition while reducing systemic risk.

Simultaneously, decentralization may create added risk to financial stability. It just depends.

These risks include:

“… the emergence of concentrations in the ownership and operation of key infrastructure and technology, as well as a possible greater degree of procyclicality in decentralized risk-taking. New uncertainties concerning the determination of legal liability and consumer protection may also affect public trust in the financial system. Recovery and resolution of decentralized structures may be more difficult.”

Of course, what is new and unproven creates challenges for regulators, policymakers, and supervisory frameworks.

The report advises that as part of the G20 discussion, authorities may wish to consider the implications of decentralized financial technologies including policy and regulatory approaches. While not providing clear policy recommendations, the authors state that Fintech and decentralization will “continue to evolve rapidly.”

“Early liaison between regulators and a wider group of stakeholders might help ensure that regulatory and other public policy objectives are considered in the initial design of technical protocols and applications.”

Crowdfund Insider has received feedback on the FSB decentralization report from industry insiders.

Nick Cowan, MD and Founder of the Gibraltar Stock Exchange (GSX) Group, an exchange that has moved rapidly to benefit from blockchain tech said the FSB report illustrates the far-reaching implications of decentralization and financial services.

Nick Cowan, MD and Founder of the Gibraltar Stock Exchange (GSX) Group, an exchange that has moved rapidly to benefit from blockchain tech said the FSB report illustrates the far-reaching implications of decentralization and financial services.

“Innovations pertaining to decentralised finance should take place in tandem with regulatory advances,” said Cowan. “It is important that institutions set up in jurisdictions with clear, adaptable regulation – as is the case in Gibraltar, a jurisdiction that has taken a lead in establishing a purpose built framework to accommodate DLT.”

Remy Jacobson, founder and CEO of RealT, said that tokenization represents a new frontier for financial instruments which will require significant research and development to mainstream the tech.

“There are some misconceptions around tokenization that are worth exploring,” said Jacobson. “For example, the concept of a deed is a legal document that represents a property asset. The same is true for a stock or bond certificate. These pieces of paper are accurately called a “token” if you view a token as a symbol or representative unit of something else. A deed was the first ever “tokenization” of a property, and made it much more easily traded and transported than the asset it represents.”

Cryptographic tokenization is just the next iteration of asset representation said Jacobson. He added that the risks mentioned in the FSB report are not unique to tokenization.

“In fact, the lack of clarity behind assets was the core of the issue behind the 2008 crash. The opaqueness of Wall Street removed investors ability to value the assets appropriately.”

He affirmed that the benefits of tokenization, including liquidity and transparency, is something missing from legacy platforms.

Sebastian Higgs, Director of Business Development at Vo1t, a cold-storage platform for digital assets, called the report a “good first step” by the FSB. But, in his opinion, some of the risks presented were overweighted and showed a lack of understanding.

Dave Hodgson, Director and Co-founder of NEM Ventures, the VC arm of the NEM blockchain ecosystem, said he was encouraged by the analysis and welcomed further engagement.

“It would be beneficial to hear from the FCA in the UK and the SEC in the US as they have thus far been quiet on their preferred approach. As a result, companies have been reliant on self-regulation combined with hefty punishments in these jurisdictions for those who have fallen victim to this regulatory uncertainty. It is also critical to consider the role that proactive regulators such as Gibraltar, Malta, Bermuda, Switzerland, and Germany will play – as regulatory certainty will allow the population to operate how it wishes, while being legally compliant,” said Hodgson.

Matt Branton, CTO of Neutral, expressed his opinion that the report indicated that decentralization has the potential to “reduce factors in the traditional financial world which often hinder financial stability.”

He said he believes that decentralized finance will lead to greater competition and diversity in the financial system and reduce the systemic importance of large, existing entities.

“In tandem with drawing focus to decentralized finance’s ability to improve and stabilize economies, the report calls out valid concerns, such as uncertainties regarding investor protection in the crypto asset sphere,” stated Branton. “Combatting these concerns will require the decentralized financial industry being explicit and defined in its utility.”

The FSB Decentralization Report is available below.