Digital wealth management platform MarketsFlow is set to close its equity crowdfunding campaign on Crowdcube later this week with more than 800,000 in funding. The initiative has notably attracted over 500 investors since its launch in April.

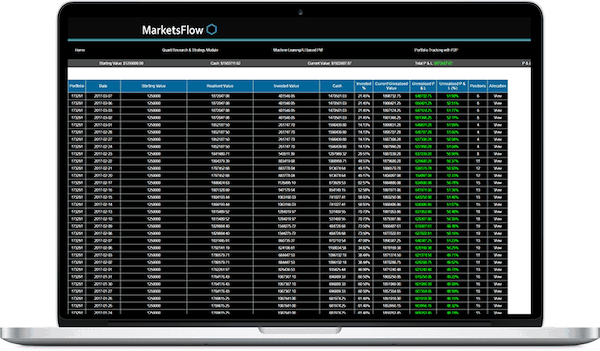

As previously reported, MarketsFlow describes itself as a sophisticated, award-winning and innovative machine learning and AI-based intelligent robo advisor and digital wealth management platform. The platform stated it uses data science to empower retail and institutional investors to make optimal investment portfolios.

“With the UK Asset Management industry worth £6.9trn, and Wealth management estimated to be £1.1 trillion by 2019, we want to empower retail and institutional clients to manage optimised portfolios, the scientific way. By applying advanced algorithms to vast amounts of unstructured financial data, our platform has the capability to produce exemplary portfolio performance in terms of annualized returns, managed volatility, sharpe ratios, and risk management.”

MarketsFlow now offers Managed Portfolios (GIA), ISAs and IRAs. The company expects its Growth and its High Growth portfolio performance will be accessible to all.

“Opening an account should be a breeze, however this process can take a week or more. Our new account registration will change this to be under 10 minutes. With our new mobile app and accessible investing, we expect a strong uptake and on top of that we are complementing our Growth using M&A deals (current deal in due diligence for £38M AUA).”

Funds from the Crowdcube round will go towards the growth and development of its platform. The campaign is set to close on Friday.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!