Last week, Comptroller of the Currency Joseph Otting testified in front of the House Financial Services Committee. The hearing was entitled, “Oversight of Prudential Regulators: Ensuring the Safety, Soundness and Accountability of Megabanks and Other Depository Institutions.”

The Office of the Comptroller of the Currency (OCC) is the federal agency that regulates, and supervises all national banks and thus plays a vital role in the operation of financial services. In 2015, the OCC proposed a new “Fintech Charter” in recognition of the growing importance of innovative financial firms seeking to provide services to consumers and businesses entirely online. While Fintech services represent the future of banking the move by the OCC to regulate these emerging businesses has been challenged by various constituent parties – most pointedly by state based regulators which do not want to see their authority undermined.

During the Hearing, innovation in financial services came up multiple times as various representatives queried Otting as well as the other participants.

In addressing Fintech during the hearing, Ottings said:

“We think the ability to bring new concepts and choices to consumers is important for the future of banking.”

He noted that a lot of the small loans are being completed via the internet and these platforms want the ability to operate across the nation, alluding to the OCC Fintech Charter. By creating a special purpose charter, the OCC seeks to provide a federal path for Fintech’s to operate across the country without having to seek permission in each individual state. The process of seeking state approval for all 50 states is a long, and costly process, that undermines innovation.

Within Otting’s written testimony submitted to the Committee, which is far longer than the oral presentation, Otting had this to say:

In July 2018, the OCC announced its decision to consider applications for special purpose national bank charters from qualifying Fintech companies engaged in the business of banking. This decision is consistent with bipartisan government efforts at federal and state levels to promote economic opportunity and support innovation and will help to provide more choices to consumers and businesses. Companies that provide banking services in innovative ways deserve the opportunity to pursue that business on a national scale as a federally chartered, regulated bank. We continue to have conversations with several such companies about the special purpose national bank charter.

A Fintech company that receives a national bank charter will be subject to the same high standards of safety and soundness and fairness that all federally chartered banks must meet. As it does for all banks under its supervision, the OCC would tailor these standards based on the bank’s size, complexity, and risk profile, consistent with applicable law. In addition, a Fintech company with a national bank charter will be supervised like similarly situated national banks, including with respect to capital, liquidity, and risk management requirements.

The OCC also expects a Fintech company that receives a national bank charter to demonstrate a commitment to financial inclusion. The nature of that commitment will depend on the company’s business model and the types of products, services, and activities it plans to provide. By applying a standard similar to that of the CRA [Community Re-investment Act] for depository institutions, the financial inclusion commitment will help ensure that special purpose national bank charters are held to the same agency expectations of fair access to financial services and fair treatment of customers.

A special purpose national bank charter is only one option for innovative companies engaged in the business of banking. Companies may also pursue a full-service national bank charter, state charter or license where available, or partner with banks and other financial service companies. The OCC Office of Innovation is a resource available to fintechs to help them understand the opportunities available to them.

Killing Innovation

In early May, the New York Department of Financial Services received a green light from the courts to push forward with a lawsuit challenging the pursuit of an OCC Fintech Charter. A recent report in American Banker said this decision is “having a chilling effect on potential applicants – IE Fintechs.”

According to the report, Otting no longer expects Fintechs to apply for the Fintech Charter as the legal challenge by the State of New York is apparently having its intended effect of killing banking innovation – at least at the federal level.

There is a similar lawsuit being pursued by the Conference of State Bank Supervisors as the various states seek to maintain their relevance.

What started under Comptroller Curry in 2015, the Fintech Charter has emerged as a political struggle that has clearly undermined financial innovation in the US. While other countries have quickly focused policy to encourage Fintech innovation, the regulatory environment of state versus federal has stymied advancement.

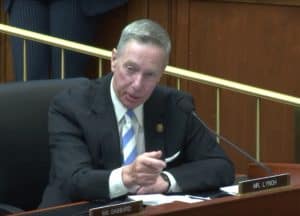

Perhaps the most encouraging discourse of the Hearing was from Representative Stephen Lynch who was recently appointed to be the Chair of the House Financial Services Committee Task Force on Fintech.

Perhaps the most encouraging discourse of the Hearing was from Representative Stephen Lynch who was recently appointed to be the Chair of the House Financial Services Committee Task Force on Fintech.

While Representative Lynch told Otting, “I think you are wasting time by trying to ram this through … You need our input,” Lynch appeared to be willing to consider a legislative fix – something that may be welcomed by Otting.

“I think your time would be better spent in dealing with the task force,” said Representative Lynch.

Lynch said that following a review the Task Force could bring a recommendation to the Committee. If Lynch is effective in his new leadership role, perhaps Congress can craft legislation that will make a Fintech Charter, or something similar, a reality. If not, the states will win a victory that only benefits an entrenched bureaucracy and not the constituents they claim to represent.