Leading marketplace lending platform Prosper announced on Monday the release of the financial results for the first quarter of 2019.

Prosper reported that during the quarter it closed its second warehouse facility with $300 million in commitments, providing the company with $500 million in total committed warehouse capacity and also sponsored its first securitization with collateral contributed by Prosper. This was the sixth issuance under the Prosper Marketplace Issuance Trust (PMIT) program with total issuance of $2.8 billion since the program’s launch in 2017. While sharing more details about the quarter results, David Kimball, CEO of Prosper, stated:

“Our first quarter results reflect our continued emphasis on sustainable long-term growth and profitability as we focus on credit and pricing discipline in our personal loan business while making significant investments in our new home equity business. We are also very pleased with the funding stability and diversification we have achieved through new investors and committed financing facilities as we near the end of our $5 billion purchase agreement with a consortium of investors that was signed in 2017.”

First Quarter 2019 Financial summary includes:

First Quarter 2019 Financial summary includes:

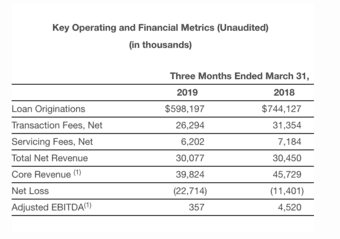

- Total Net Revenue, which includes the non-cash impact related to warrants to purchase preferred stock, decreased to $30.1 million in Q1 2019 compared to $30.5 million in Q1 2018.

- Core Revenue, which excludes the non-cash impact related to warrants to purchase preferred stock, decreased to $39.8 million in Q1 2019 compared to $45.7 million in Q1 2018.

- Net Loss increased to ($22.7) million in Q1 2019 compared to a Net Loss of ($11.4) million in Q1 2018.

- Adjusted EBITDA decreased to $0.4 million in Q1 2019 compared to $4.5 million in Q1 2018.

The release of the financial results comes just a few weeks after Prosper reportedly settled fraud charges for misstating returns, according to a release from the Securities and Exchange Commission (SEC). As previously reported, Prosper, without admitting or denying the allegations, has consented to an SEC order finding it violated an anti-fraud provision of the Securities Act of 1933. Prosper Funding LLC has agreed to pay a $3 million penalty for “miscalculating and materially overstating annualized net returns to retail and other investors.”