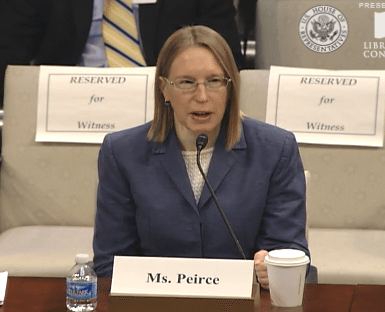

Securities and Exchange Commissioner (SEC) Hester Peirce delivered a speech at the Cato Fintech event in SF this week tackling an important topic: That of regulators (and policymakers in general) being too risk averse.

Securities and Exchange Commissioner (SEC) Hester Peirce delivered a speech at the Cato Fintech event in SF this week tackling an important topic: That of regulators (and policymakers in general) being too risk averse.

This is a truism in policy. We elect, or appoint, public officials to help guide society on a prosperous path for all, but once ensconced in their selected office they pursue their mandate with unfettered regulatory gusto.

Congress people constantly write legislation and regulators enforce and craft new rules. The unfortunate truth is that, all too often as a society, we need less of this erstwhile governmental wisdom, and more opportunity to depend on our own common sense.

Peirce explains;

“When investor risk-taking leads to investor losses, regulators inevitably face criticism for allowing investors to take risks that, in hindsight, appear to have offered nothing but downside. We know what inevitably follows—a chorus of critics insisting that “If you, Ms. Regulator, had simply told people they were not allowed to engage in risky behavior, nobody would have gotten hurt!”

Yep, she’s right.

And the Commissioner is correct again in explaining that something always goes wrong. It is inevitable.

“Companies fail. Fraudsters cheat. Nature strikes. Market downturns happen.”

That is how any economy operates. Life happens.

So where does the regulator, or policymaker, draw the line between complicit inaction and excessive, innovation killing over regulation?

Should we outlaw driving because, inevitably, too many of us will encounter an accident at some point in our lives? At what point are we responsible for our own decisions, some which may be quite bad, as opposed to the guidance of the all powerful government?

Peirce draws the line when it comes to securities regulation;

“It puzzles me that it is so difficult for those of us who regulate the securities markets to understand this concept; after all, capital markets are all about taking risk, and queasiness around risk-taking is particularly inapt. A key purpose of financial markets is to permit investors to take risks, commensurate with their own risk appetites and circumstances, to earn returns on their investments. They commit their capital to projects with uncertain outcomes in the hope that there will be a return on their capital investment. The SEC, as regulator of the capital markets, therefore should appreciate the connection between risk and return and resist the urge to coddle the American investor … actions that we take at the SEC to protect the American investor may reflect a desire to reduce certain types of investor risk-taking that may pose reputational damage to the Commission in the event of investor losses. But Congress did not ask us to guarantee that investors would never lose money. Nor did Congress direct us to substitute our own investment judgment for that of investors. And certainly Congress has never suggested that avoiding or eliminating risk to the Commission should inform our approach to protecting investors.” [emphasis added]

CryptoMom

Not too long ago, Commissioner Peirce published a public dissent pertaining to the Commission’s decision to reject an exchange-traded product derived from Bitcoin. This ostensibly pro-Bitcoin statement earned her the affection of certain crypto-advocates that also helped her gain the title of CryptoMom. Peirce notes that enthusiasm for crypto-investing is not enjoying the same enthusiasm at the Commission.

It is clear that there is strong interest among some investors for this type of product, and innovators in the sector have made many attempts to respond to this interest (some of which are more legitimate than others). So far, however, the SEC has not shared these investors’ desires, but Peirce believes their cautious approach may be misdirected.

It is clear that there is strong interest among some investors for this type of product, and innovators in the sector have made many attempts to respond to this interest (some of which are more legitimate than others). So far, however, the SEC has not shared these investors’ desires, but Peirce believes their cautious approach may be misdirected.

“To date, the SEC has stopped all such retail products from getting to market. To shift my metaphor a bit, the SEC helicopters in with good intentions, but often without sufficient concern for the way its regulatory blades roil the markets, frustrate innovation, and potentially expose investors to greater risks.”

During her relatively brief tenure at the Commission, Peirce has derived the following five lessons from her experience as a regulator. It is this experience she seeks to leverage to further enable Fintech innovation;

- First, because most of us regulators are neither entrepreneurs nor technologists, we should respond to attempts to bring innovative solutions into the financial markets with an appropriate degree of humility … We should resist the temptation to treat uncertainty as a disqualifier…

- Either create space for innovations to occur in our regulated markets or prepare for investors to seek out such innovations in less-regulated, or unregulated, spaces, such as foreign-registered products that lack the transparency that trading under our rules would provide

- An essential step to encouraging innovations in our markets is to provide innovators with greater clarity and certainty in their interactions with the Commission and its staff

- …Our investor protection role needs to incorporate a commitment to expanding investor access to our financial markets, including through innovative technologies

- If we do not become more comfortable with risk, our helicoptering may so burden Fintech innovations that they begin to lumber along at a regulatory pace. In addition, because the financial markets are so heavily regulated, a lot of firms’ resources—including valuable coding and data analysis resources—go to meeting regulatory demands

Interestingly, Peirce is not a believer in the oft-mentioned Fintech Sandbox approach but advocates on behalf of “self certification” of Fintech experiments that are “consistent with the spirit of regulatory obligations.” She does propose an new Office of Innovation at the SEC. (Perhaps the still unfilled position of Small Business Advocate could share that title?)

Peirce has quickly emerged as one of the most thoughtful and insightful financial regulators of our times. Her ability to analyze the very fluid Fintech marketplace and recognize incumbent regulatory bottlenecks, that harm consumers and businesses alike, should be recognized.

The DC political circus tends to drive good policy into the abyss of benign mediocre acceptance. Or even worse, the DC echo chamber creates knee jerk rules designed to save us from ourselves that have unintended consequences. Fintech innovation dearly needs more leaders like Commissioner Peirce.

You may read the speech in its entirety here.