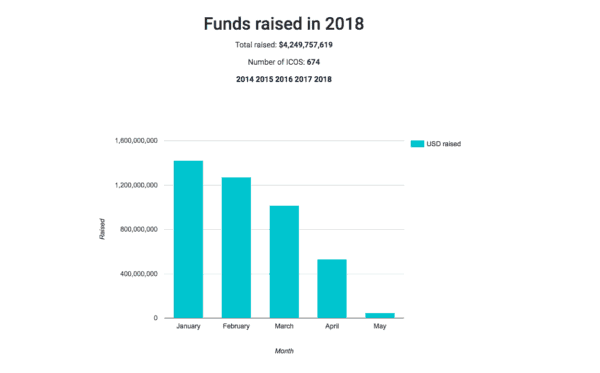

ICOData.io, a company that rates Initial Coin Offering (ICOs) to remedy an “intelligence deficit” in the market, has published data showing that ICO investing dropped by almost two-thirds in the first four months of 2018.

The organization has just published a chart showing that funds sent to ICOs tracked by ICOData.io declined from about $1.423 billion in January to approximately $533 million in April.

Initial Coin Offerings (ICOs) are a direct means of investing in startups through digital coins or tokens issued using software. People soliciting funds by ICO argue that the practice inhabits a regulatory grey area.

Others have been harshly critical of the practice, which they characterize as issuing unregulated security with little to no obligation to investors. Expansive hype around ICOs means companies have raised millions, even hundreds of millions of dollars- without even so much as a working prototype.

“In most cases,” says the ICOData.io website, “the tokens or coins being sold are for platforms and businesses that have yet to be fully built, or even worse, exist only as an idea.”

After Bitcoin soared to $20 000 US last December, the precipitous 70% drop in the price of Bitcoin that followed during the early months 2018 was tracked by a majority of altcoins issued through ICOs.

Though Pantera Capital, announced in mid-April that Bitcoin had bottomed at $6500, the currency has yet to embark on a full-fledged breakout to the upside. Nonetheless, rumours of Bitcoin’s return have translated into some recent gains for altcoins.

Many critics have argued that because altcoins created in ICO’s initially have small supply, these coins can easily be manipulated on exchanges by founders who vested themselves in pre-ICOs or by early buyers holding big positions. Once the coins hit exchanges, founders and other early investors are known to have blatantly wash traded tokens back and forth between themselves on minimally regulated exchanges, thereby kicking off a pump by creating the illusion of demand for the coins.

Many critics have argued that because altcoins created in ICO’s initially have small supply, these coins can easily be manipulated on exchanges by founders who vested themselves in pre-ICOs or by early buyers holding big positions. Once the coins hit exchanges, founders and other early investors are known to have blatantly wash traded tokens back and forth between themselves on minimally regulated exchanges, thereby kicking off a pump by creating the illusion of demand for the coins.

Founders can also easily spend funds raised in ICOs on hype campaigns rather than product development. Coin founders build hype in social media “communities” then release coins onto exchanges or through free “air drops” of coins.

Various types of manipulation and excitation of markets often generate big run ups followed by awesome “dumps” of coins by indifferent traders who got in at huge discounts before exchange buyers. This game has often lead to long subsequent periods of a coin’s price crawling on its belly after a crash, whereby badly-positioned, naive investors wait for the right combinbation of hype (often “rumours” or announcements of “possible partnerships” or unscrupulous paid “endorsements”) that might favour another run up.

Terms in many ICOs explicitly state that the company has zero obligation to investors. Vitalik Buterin, who invented Ethereum and upon whose platform the majority of ICOs have been built, proposed an improved model of ICOs in January that he called DAICOs.

DAICO models enshrine greater investor involvement, a gradual release of investor funds to companies and powerful voting rights.

So far, very very few companies have opted to do DAICOs instead of ICOs.

Numerous experienced cryptocurrency influencers have warned the public about the current state of ICOs:

I'm not against ICOs. I think they will become a valuable fundraising tool as they mature. Right now I see 99.99% junk.

— Andreas (aantonop) (@aantonop) September 6, 2017

The Kik ICO is nonsense

— Tone Vays (@ToneVays) May 28, 2017

The most audacious and sneaky pitch for an ICO I've ever received. Propaganda tactics of alarmism, virtue signaling, misinformation, appeal to prejudice, guilt tripping, feigning altruism, and projection – all squeezed into 9 paragraphs. #BitcoinGreen pic.twitter.com/FnjlCaoRy6

— Tuur Demeester (@TuurDemeester) May 3, 2018

This year the US Securities Exchange Commission issued numerous subpoenas to companies that had done ICOs in its jurisdiction, the New York State Attorney General sent letters to 13 cryptocurrency exchanges requesting extensive operational info, and a prominent ICO influencer, Ian Balina, was the victim of a hack that saw two million dollars worth of his alt coin holdings stolen.

ICOData.io’s findings suggest that cautionary messages may be reaching the ground and that last year’s ICO exuberance may have abated for a time.

The ICOData.io website uses a passage from the New York Times written by Kevin Roose to explain how ICOs work:

“If you’re having trouble picturing it: Imagine that a friend is building a casino and asks you to invest. In exchange, you get chips that can be used at the casino’s tables once it’s finished. Now imagine that the value of the chips isn’t fixed, and will instead fluctuate depending on the popularity of the casino, the number of other gamblers and the regulatory environment for casinos. Oh, and instead of a friend, imagine it’s a stranger on the internet who might be using a fake name, who might not actually know how to build a casino, and whom you probably can’t sue for fraud if he steals your money and uses it to buy a Porsche instead. That’s an ICO.”

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!