Last week, CB Insights published their quarterly report on global investment into Fintech and following the numbers from Q1 the authors are making a bullish prediction. They expect global Fintech investment to hit a new high during 2018.

The first quarter of 2018 saw 323 deals funded to the tune of $5.417 billion. In Q1 of 2017, 276 deals received $2.886 billion.

2017 was the biggest year for Fintech deals since CB Insights started tracking so the authors expect 2018 to top the $16.5 billion invested during last year.

[clickToTweet tweet=”2017 was the biggest year for #Fintech deals since CB Insights started tracking so the authors expect 2018 to top the $16.5 billion invested during last year” quote=”2017 was the biggest year for #Fintech deals since CB Insights started tracking so the authors expect 2018 to top the $16.5 billion invested during last year”]

Some points of interest:

- The US market was very active in Q1 as 147 deals were funded for $2.1 billion. California saw 2X more deals than New York

- The European market experienced 63 deals funded for $933 million. The number of deals dipped to a 5 quarter low but total funded rose

- Asia had 86 deals backed for $2 billion

- The online lending sector is in decline as investors move into other areas of Fintech.

- Globally there are now 26 Fintech Unicorns with an aggregate value of around $77.6 billion

The top five Fintech deals in Q1 were as follows:

- OneConnect – part of Ping An, a platform for financial account management for SMEs

- Atom – a UK based challenger bank

- Oscar – Health Insurtech

- Wecash – Alternative credit risk monitoring and assessment platform for individuals

- N26 – a Germany based Challenger bank

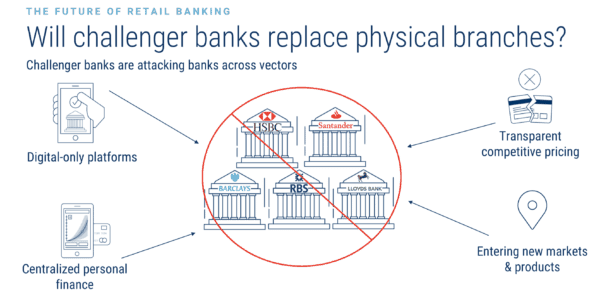

Three of the top 7 deals were for challenger banks (NU Bank in Brazil) as the banking industry continues to separate from brick and mortar operations.

As for initial coin offerings, this sector lost momentum during March following a strong January and February. In fact January was the most active month ever for ICOs topping an estimated $1.6 billion. March numbers stood at less than a third of that most likely due to the heightened enforcement environment in the US. But even while “pure play ICOs” dip, VCs continue to back security token offerings and platforms.

This is a good report. You may download it for free once you hand over your email address at CB Insights.