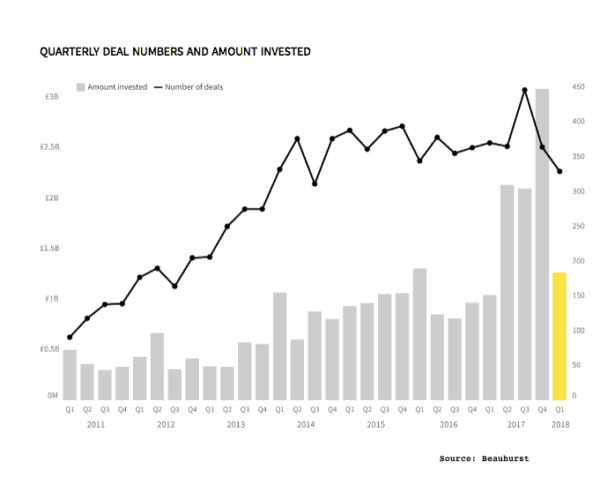

Beauhurst is out with their quarterly deal report for UK equity investment activity and according to their data deal numbers fell to their lowest level since Q3 of 2014. Additionally, Q1 delivered the lowest ever percentage of deals under the half a million pound hurdle.

In brief these are the high level numbers:

- In Q1, UK equity deals numbered 329, a decline of 9.6% versus Q4

- Total amount invested stood at £1.26 billion, a decrease of 59.2% versus Q4

- Both Blockchain and Insturtech deals saw strong growth in the quarter

As previously reported, Beauhurst said there appears to be a trend of fewer but bigger deals but the number of deals at every stage declined.

Risk Off?

But it is not all bad news. In fact there are some very encouraging insights in the Beauhurst report.

But it is not all bad news. In fact there are some very encouraging insights in the Beauhurst report.

If you look at the UK crowdfunding numbers, Q1 of 2018 saw £53.8 million in deal flow. This is a decline from Q4 that showed £68.8 million in deal flow but when looking year over year the investment crowdfunding sector showed very strong growth.

- Q1 2018 £53.8 million in deals vs. Q1 2017 £39.9 in deals

- In Q1, Crowdcube had 35 deals at £21.2 million

- In Q1, Seedrs had 32 deals at £13.7 million

- SyndicateRoom and VentureFounders rounded out the top 4 spots at £8.8 million (13) and £6.8 million (3) respectively

Now the question remains, can the crowdfunding sector keep up the momentum?