The Bitcoin Foundation has been working diligently to mitigate language of pending legislation, “The Combating Money Laundering, Terrorist Financing, and Counterfeiting Act of 2017″ (S.1241), in the US Senate that would define anyone issuing, redeeming or cashing Bitcoin as a financial institution. Think about what that means for moment. You, a mere Bitcoin holder, may be subject to formal reporting structures similar to a bank. As Bitcoin becomes more mainstream this language simply does not work unless you live in Xanadu but, as we all know too well, the US Congress has a reputation of creating untenable laws from time to time. Just look at the Dodd-Frank debacle. History does have a tendency to repeat itself.

Granted, cryptocurrencies are a new financial vehicle and the issues surrounding crypto transactions can be complex. That is why you have people like the Bitcoin Foundation working to help craft more reasonable rules with appropriate safeguards that do not throw out the proverbial “baby with the bathwater.”

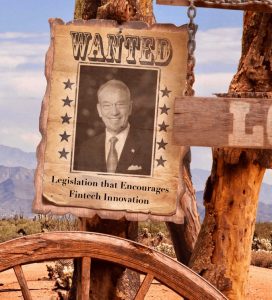

In a letter signed by Llew Claasen sent to the Ephraim Wernick, Counsel, and Senator Chuck Grassley, Chair of the Senate Judiciary Committee, the Foundation explains its perspective:

In a letter signed by Llew Claasen sent to the Ephraim Wernick, Counsel, and Senator Chuck Grassley, Chair of the Senate Judiciary Committee, the Foundation explains its perspective:

“The Bitcoin Foundation continues to oppose much of Section 13 of the Bill. As drafted, Section 13 of the Bill would, in our view, effectively limit or even terminate development, at least in the United States, of this important technology because the burdens of compliance would be greater in many instances than the benefit of developing the technology in the United States. Moreover, buying and selling virtual currency is often more like buying and selling commodities and less like transacting in money. At minimum, the Bitcoin Foundation believes that further research and review of this developing and complex area is needed before AML obligations are applied, other than obligations that are already applied, for example through the Financial Crimes Enforcement Nework (“FinCEN”) of the U.S. Department of the Treasury (the “Treasury”).”

The crux of the issue is the definition of digital currency. The Foundation posits that digital or virtual currencies references cryptocurrencies and tokens. Using a general term may engulf all cryptocurrencies and transactions requiring anti-money laundering (AML) compliance for everyone touching Bitcoin etc. thus snuffing out domestic relevance for an emerging financial innovation. The Foundation has submitted language for a revision to mitigate the opaque language incorporated now.

On November 28th, there was a Senate hearing on S.1241. In a second letter addressed to Wernick and Senator Grassley, the Foundation noted that, while AML rules are important, none of the witnesses were able to “distinguish between criminal activity and the impact of the Bill on specific payment methods.” The selected panel is described as being ill-suited to address the burden that may be created by additional rules impacting cryptocurrency innovation while pointing to the fact that most enforcement challenges currently involve traditional currency issues (and not crypto).

Additionally, the Foundation calls written testimony provided by Kenneth Blanco, Deputy Attorney General, US Department of Justice, as disingenuous at best having misconstrued electronic payments with Bitcoin utilization.

Perhaps some of the testimony provided by the hearing was slanted towards a pre-crypto universe?

Can Elected Officials Keep Up with Fintech Innovation?

Part of the challenge here is you have a legislative body that is trying to keep up with a fast changing world of finance but may be falling short of the goal due to a lack of sophistication or awareness. Rushing through legislation with disregard to the unintended consequences (perhaps) of the importance of financial innovation is myopic at best.

Part of the challenge here is you have a legislative body that is trying to keep up with a fast changing world of finance but may be falling short of the goal due to a lack of sophistication or awareness. Rushing through legislation with disregard to the unintended consequences (perhaps) of the importance of financial innovation is myopic at best.

In Australia, recent legislation sought to tackle a similar issue. Legislators worked directly with the Fintech industry to assure innovation was not snuffed out.

In the UK, HM Treasury and the Home Office published a report on money laundering and terrorist financing in October. In brief, the authors described the risk of utilization of cryptocurrency by criminals as low. But, over time as usage of crypto grows, the authors expect illicit activities to understandably rise. But what was missing from the UK report was any imperative need to craft rules that would hobble digital currency or cryptocurrency utilization.

We should demand, and expect, more from elected officials. Shortcuts to challenging policy issues should not rule the legislative pile. Hopefully, the Judiciary Committee will push pause on potentially harmful cryptocurrency legislation until they have a better handle on the regulatory ramifications.