BrewDog and its Equity for Punks crowdfunding project is at it once again. The Scottish craft brewer is returning to the UK with a securities offer following the end of its US Reg A+ crowdfunding round. To date, BrewDog has raised around £41 million in its four prior crowdfunding rounds, enlisting over 53,000 shareholders making it one of the most successful investment crowdfunding offers of all time. Equity for Punks V seeks a minimum £10 million raise at a per share price of £23.75 (minimum purchase of 2 shares). The crowdfunding cap stands at £50 million. As of today, almost £3 million has been raised backed over 5700 investors. Contrast this progress to the BrewDog USA crowdfunding campaign under Reg A+, an offer that was live for many months that raised $7 million from around 9000 investors, and the UK offering clearly has better momentum.

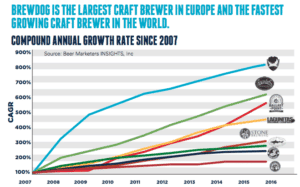

Earlier this year, BrewDog accepted institutional money that delivered Unicorn status to the upstart brewer. BrewDog received £213 million for a 22% ownership stake from private equity firm TSG delivering a £1 billion valuation. This current funding round has pegged a post money valuation of £1.7 billion (if it is fully subscribed). That is a pretty hefty leap since TSG jumped aboard. So is it worth the premium? That is the billion dollar question, I guess. BrewDog is growing both the top and bottom line and they expect to continue rolling out more brewpubs while expanding their distribution presence. BrewDog explains they are the largest craft brewer in Europe and the fastest growing craft brewer in the world.

Earlier this year, BrewDog accepted institutional money that delivered Unicorn status to the upstart brewer. BrewDog received £213 million for a 22% ownership stake from private equity firm TSG delivering a £1 billion valuation. This current funding round has pegged a post money valuation of £1.7 billion (if it is fully subscribed). That is a pretty hefty leap since TSG jumped aboard. So is it worth the premium? That is the billion dollar question, I guess. BrewDog is growing both the top and bottom line and they expect to continue rolling out more brewpubs while expanding their distribution presence. BrewDog explains they are the largest craft brewer in Europe and the fastest growing craft brewer in the world.

So far early investors have generated decent gains, at least on paper. In Equity for Punks crowdfunding round 1, shareholders saw a 2765% return. The last EFP round (in the UK in April 2016) generated an estimated 177% return for investors. BrewDog is not currently listed on any public exchange so liquidity is limited if you happen to want to get out. There is no guarantee BrewDog will ever list on an exchange but it would not be a stretch for that to happen as investors inevitably expect an opportunity to benefit from any paper gains.

So far early investors have generated decent gains, at least on paper. In Equity for Punks crowdfunding round 1, shareholders saw a 2765% return. The last EFP round (in the UK in April 2016) generated an estimated 177% return for investors. BrewDog is not currently listed on any public exchange so liquidity is limited if you happen to want to get out. There is no guarantee BrewDog will ever list on an exchange but it would not be a stretch for that to happen as investors inevitably expect an opportunity to benefit from any paper gains.

By this time BrewDog has these UK investment crowdfunding rounds down to a science. Investors not only receive shares but certain perks designed to create a sense of community and brand commitment. In the end it is really about growth. As long as BrewDog can keep growing at such a rapid pace, investors stand a chance to benefit. When growth starts to slow, which it inevitably will at some point in the future, shares may not capture such a frothy premium. But for now the crowdfunding tap is flowing freely.

The BrewDog Prospectus is available here.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!