Chief Deputy Whip Patrick McHenry, the Vice Chairman of the House Financial Services Committee has partnered with Congressman Gregory Meeks to introduce HR 3299 entitled, “Protecting Consumers’ Access to Credit Act of 2017“.

Chief Deputy Whip Patrick McHenry, the Vice Chairman of the House Financial Services Committee has partnered with Congressman Gregory Meeks to introduce HR 3299 entitled, “Protecting Consumers’ Access to Credit Act of 2017“.

This bill is designed to “restore consistency to our nation’s lending laws to reflect the new realities of financial innovation following the United States Court of Appeals for the Second Circuit’s decision in the Madden v. Midland Funding, LLC case.”

Last year, the Supreme Court declined to hear the Madden v. Midland case. In Madden, the Second Circuit held that the National Bank Act, which preempts state usury laws regulating the interest a national bank may charge on a loan, does not have a preemptive effect after the national bank has sold or otherwise assigned the loan to another party. This ruling caused concern within the emerging online lending industry, specifically marketplace lenders (P2P) that sell loans to outside investors. H.R. 3299 reaffirms the legal precedent under federal banking laws that preempts a loan’s interest as valid when made.

The two Congressmen stated that this reading of the National Bank Act was unprecedented and has created uncertainty for Fintech companies, financial institutions, and the credit markets.

“By codifying long-standing legal precedent with the valid-when-made doctrine, we ensure that low and middle-income Americans can access our financial markets,” said Congressman McHenry. “But this bill does more than promote financial inclusion, it also increases stability in our capital markets which have been upended by the Second Circuit’s unprecedented interpretation of our banking laws.”

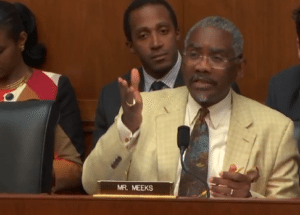

Congressman Meeks echoed his support of financial innovation that is poised to provide more inclusive financial services;

Congressman Meeks echoed his support of financial innovation that is poised to provide more inclusive financial services;

“I have been encouraged by the innovative partnerships banks and Fintech firms have forged to expand access to credit in under served urban and rural areas,” said Congressman Meeks. “Since the financial crisis, nearly 5,000 brick and mortar branches shut their doors leaving many consumers without accessibility to affordable financial services. By partnering with Fintech innovators, banks – including a number of those certified as Community Development Financial Institutions – have been able to achieve efficiencies in underwriting, allowing them to lower costs and reinvest in communities that stand to benefit the most. Such partnerships should be encouraged by policymakers and I am proud to work with Rep. McHenry to see that they are.”