This article is my attempt at providing a definitive guide to the complex, and so far, self-regulated, landscape of ICOs. Warning: mature content.

What on Earth is ICO?

Just as how in the ancient movie “Eyes Wide Shut” the password “fidelio” gave access to a very sought-after club, it looks like the magic letters ICO are the key to unlocking a door to a world of highly coveted startup capital.

When someone recently asked me if he should raise money for his new pizza restaurant here in Los Angeles via ICO, I figured it was time to write this explanatory piece.

ICO stands for Initial Coin Offering – a relatively new fundraising tool that allows some startups to raise capital by issuing and selling to the public their own cryptocurrency, aka digital tokens. Fundamentally, ICOs raise funds in Bitcoin or other cryptocurrencies.

It all got started in 2013 thanks to a blockchain protocol, Mastercoin, that quietly staged the very first ICO with a mind-blowing raise of $500,000. But momentum really built in 2016 when we saw 69 startups raising a total of $103 million. Now a further skyrocketing number of gems are emerging this year and the dynamics are promising.

As of today, we have over 800 “micro” cryptocurrencies with 8 cryptocurrencies that are worth more than $1 billion.

The mainstream media has finally taken notice, highlighting stories like that of Ethereum, raising easily almost $18 million at then bitcoin price and today its market capitalization sits at nearly $24 billion. Meanwhile the DAO (=Decentralized Autonomous Organization), one of the projects using Ethereum, created what is called a Smart Contract – a tool that would allow the funding of projects based on participants voting in a similar way as with a traditional venture capital model (for more on Smart Contracts: read HERE and HERE).

When I reached out Smith+Crown, the leading source in reporting and analysis for cryptofinancial markets, I wanted to understand not only the dynamics but also who are the champions. Here you are.

Top Five Tokens Sales as of July 11th, 2017*

| Rank | Project Name | Total Funds Raised |

|---|---|---|

| 1 | Bancor | $148 Million |

| 2 | Status | $101 Million |

| 3 | MobileGO | $54 Million |

| 4 | Basic Attention Token | $36 Million |

| 5 | Storj (second round) | $30 Million |

Source: Smith + Crown; amounts rounded to the nearest million

In the words of Mark Twain, “whenever you find yourself on the side of the majority, it is time to pause and reflect. “

In the words of Mark Twain, “whenever you find yourself on the side of the majority, it is time to pause and reflect. “

As I have been a silent observer of what the majority perceived a “mass madness,” calling ICOs names such as “Idiots Constantly Overbuying” seduced by “DNT” (do nothing technology) “launching” some (sarcastic) campaigns like this one, I cannot help but wonder – if it is so good in practice, how is it in theory? How do you stage an ICO? What is the exact algorithm and a legal framework? Who can do it beyond the tech world? How much does it cost? Who on Earth is investing in ICOs and why? Will this tool eventually be able to incentivize truly impactful ventures?

In searching for answers, let’s proceed with caution – so far, it’s dark down there. But hey – typically, that’s where the fun is.

Who let the dogs out?

After studying countless cases (check out ICOs’ trackers HERE and HERE) and brain-damaging papers, I reached out to a mastermind in this emerging world, Brock Pierce – a legendary Chairman of the Bitcoin Foundation and co-founder of Blockchain Capital.

I told him I had lost sleep over ICOs, searching for a recipe or magic formula (preferably in a one line description) that can be used by us, simple humans. Brock responded;

“Every ICO is unique, there isn’t a template yet so defining them is done on a deal by deal basis”. But – he continued – “ICOs are the future. The IPO and venture capital markets are dead, they don’t realize it yet”.

Just as our chat was happening, as fate would have it, the celebrated billionaire and former Bitcoin skeptic Mark Cuban, who just a few weeks ago called Bitcoin a “bubble,” consequently pulling Bitcoin’s price down by 5%, announced that he is now looking to back an ICO for Unikrn – an eSports betting venture.

Just as our chat was happening, as fate would have it, the celebrated billionaire and former Bitcoin skeptic Mark Cuban, who just a few weeks ago called Bitcoin a “bubble,” consequently pulling Bitcoin’s price down by 5%, announced that he is now looking to back an ICO for Unikrn – an eSports betting venture.

Then you need to add another celebrity-billionaire, a VC by birth and now a TV personality too, Tim Draper, who has announced his participation in the ICO of Tezos, a blockchain platform.

And just when you thought there were enough people on the party list, also joining in the fun is Russia – my mother-country and home to a massive number of leading mathematicians, IT scientists and chess players (yes, it was my favorite game too when I was five). Case in point – Russian billionaire Boris Titov and Waves Platform are now working on launching an Initial Coin Offering incubator with Deloitte CIS being on the case too. From what I can observe, Russia is becoming a major player in the cryptofinancing scene.

Meanwhile India, the second largest country in the world with a population of 1.3 billion (and counting), recently ruled in favor of regulating Bitcoin and announced it is currently working on those regulations.

I bet you realize by now, the trend is international, and something that we should not ignore.

To quote Pavel Vrublevsky, head of the Russian payments firm Chronopay;

“As soon as I saw that people were raising real money in ICOs I got interested. Make Bitcoin not war”.

If this is what it takes to stop wars – I agree.

Basics: ICOs vs IPOs

If you are wondering if there is any resemblance between ICO and the similar sounding IPO, here’s a recap that should help you to answer that question.

Fundamentally, Initial Public Offering (IPO) is a process undertaken by a private company motivated by two main goals: to raise capital from the general public and to provide liquidity for its existing shareholders – typically angel investors, aka accredited investors with a certain level of wealth and/or reported income as defined by the Security and Exchange Commission (SEC). The “pre-IPO” investors presume that shares of the new born public company can be easily monetized and/or traded among investors on stock exchanges. The median age of companies staged IPOs in 2001-2015 was 10 years plus, according to PWC reports, on average companies incur $3.7 million of costs directly attributable to their IPO. And – we are seeing signs of less optimism looking ahead.

*Source: Renaissancecapital.com; data last updated on July 15th, 2017

Initial Coin Offering (ICO), which I suspect sounds very similar to IPO deliberately, can be launched at MUCH earlier stages, typically by startups rooted in blockchain technology that are looking to raise external capital and achieve liquidity as well. (Learn more about blockchain HERE and HERE).

But instead of issuing their equity/stocks, they issue their own digital cryptocurrencies, aka “tokens,” that can be bought by the general public with the expectation that the tokens eventually will be listed on cryptocurrency exchanges soon after ICO, therefore brining a liquidity to backers (secondary market).

This has earned ICO a few nicknames including “crowdsales” and a Token Distribution Event (TDE) – this last term (which I like the most) I learned from David Orban – a managing partner of Network Society Ventures and a well-known innovator and visionary in the blockchain community.

OK, so far so good– after all, if you are a founder and someone who is urgently searching for capital, you might like the fact that you are not selling equities, therefore you are not losing your ownership stake. You might ask though – how come my backers could convert my tokens into money and presumably make some profits?

Good question – fair question. In fact – let me add another one.

As the question is not only how to convert tokens into money – the question is how they can become money – or a new form of it, to put it less dramatically.

Let’s explore.

Money vs tokens

You see, back in the 17th century some transactions were conducted with dried corn or beaver pelts but since they were widely accepted, even they would sound like a good deal if you had taken a time machine for an enlightening trip to the past. Never mind gold, which still is widely desirable despite its worth being based purely on people’s perceptions – yes, just like dried corn or beaver pelts were.

You see, back in the 17th century some transactions were conducted with dried corn or beaver pelts but since they were widely accepted, even they would sound like a good deal if you had taken a time machine for an enlightening trip to the past. Never mind gold, which still is widely desirable despite its worth being based purely on people’s perceptions – yes, just like dried corn or beaver pelts were.

But I can certainly relate when you wonder what on Earth your backers would need your tokens for. So, this is where there might be our “a-ha!” moment.

As you might have noticed, we live in a world of perceptions. I am talking about the financing world too where prices are not equal to marginal opportunity costs, but the perceived one (Austrian school of economics). Or – “the subjective value makes value” in the word of another blockchain genius, philosopher and writer I had a chance to talk to, David Koepsell, the founder of Encrypgen.

Evidently, in this age we don’t need any physical commodity to back up our deals and transactions so we are utilizing what is known as “fiat money” – to put it simply, it is a currency that has been created by an act of federal law and declared/recognized by a government as money – medium for exchange, a unit of account and a store of value.

Where is the promised a-ha moment?

Well, by now you might realize that our money, in the traditional sense, has no intrinsic value in itself for whatever but nevertheless is easily convertible into payments for any goods and services. Why? Because our government told us so and if anything – its mission to keep our faith in the nation’s currency as it is the people’s faith what determines the value of money and its ability to pay for things. Yes, just like in the 17th century.

Now, please hold this thought.

How Bitcoin has become the money – well, almost

If I did a good job in explaining here a topic which usually requires a dozen lectures, a few books and probably a shot of tequila to understand, you can tell that in order for any currency to be acting like money, then fundamentally there should be two components present:

1) people must have faith in it and therefore will allocate the value needed;

2) a government should accept and declare it to be a legal tender (i.e., fiat currency)

This is when you might want to start educating yourself on “Bitcoin” – the very first cryptocurrency which hit the Internet community eight years ago as the original enactment of blockchain. (To educate yourself more on bitcoin: read HERE, HERE and HERE).

The project quickly became a massive social movement and, unless you have been in a coma for the past few years – or, well drank too much tequila (hey, don’t blame it on me) you must have heard Bitcoin declared to be the new gold. It’s a “digital gold” that, thanks to blockchain technology, has brought the concept of decentralized digital money to life with a promise to eventually free us all from the chains of the existing financial world ruled by government.

The project quickly became a massive social movement and, unless you have been in a coma for the past few years – or, well drank too much tequila (hey, don’t blame it on me) you must have heard Bitcoin declared to be the new gold. It’s a “digital gold” that, thanks to blockchain technology, has brought the concept of decentralized digital money to life with a promise to eventually free us all from the chains of the existing financial world ruled by government.

Earlier this year, a single bitcoin, which is basically a code on a computer record, got valued at more worth than one ounce of gold – in the process shocking some experts who were asking, “How can value be created out of nothing?”

Well, they forgot about the basics – faith is what creates value for money first and foremost. And since we’ve got an army of devoted believers in Bitcoin and “the faith is strong with this one” this might enlighten you on understanding the Bitcoin phenomena.

Where is the revolution? Bitcoin has managed to bypass the government’s eye as a code of cryptocurrency has its own set of rules for compliance (if you don’t complain, you’ll be rejected by the network) and it allows you to make transactions directly – without your bank or any third party, aka middle men.

Bitcoin’s closest rival Ether, which I mentioned in the begging of this never-ending piece, is surging in popularity too and has returned roughly 4,000 percent since January. As the popularity of trading cryptocurrencies soars, can Bitcoin – or, say, Ether, move from being a virtual currency to fiat money in the traditional sense?

Sure – but only if the government would accept such currencies – or grant one of them with the privilege of that currency being used to pay taxes. The capability to realize any governmental requirements for payments and fees directly is unique to fiat currency and is the main distinguishing characteristic to any alternative currencies.

BTW, if you think that a scenario where a government would re-accommodate its monetary settings is within the realm of science fiction – think again. Average gross government debt reached 112% of GDP across OECD countries and we know there is already a very sizeable amount of debt (and we don’t know about the unofficial amount) related to the US dollar, the Euro, the Chinese Yuan and even the Japanese Yen (See some very cool visualization pictures HERE.)

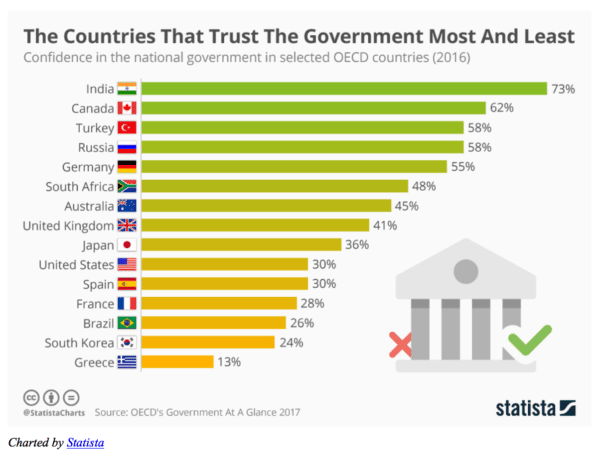

Add the fact that public trust in governments near historic lows (check out the latest edition of the OECD’s Government at a Glance report and an enlightening chart below) and remember my passage above about faith: this variable is the most important in the formula of money.

So, let’s think for a moment while putting ourselves in the government’s shoes: if you can’t stop the movement, why not lead it?

Stay tuned.

How to ICO in brief: legal, technicalities and more

Since token sales are falling into something between being donations and investments and there is still not a defined legal framework, I would strongly encourage you to learn in depth what you are getting into. Talk to your legal counsel or find one. Meanwhile, the best summary of legal issues surrounding ICOs I discovered HERE; I would also recommend subscribing to LegalTechNews.com.

And while, echoing Brock, there isn’t a template yet I would still like everyone to understand the general simplified algorithm involved, so here are some steps:

- First, you would have to choose your currency. As of today, funds that are raised via ICOs are most frequently received in Bitcoins (BTC) or Ether (ETH).

- Once you choose your currency unit, you will need to create a Bitcoin or Ethereum address so you can display a link with an address for receiving funds right on your webpage – a bit similar to what you would have to create if you were launching your campaign on Kickstarter, for example, or displaying your bank account info on your webpage for your backers/donors to send money to.

- On your webpage, you should describe your business, use of funds and why anyone should believe in the value you are building – so pretty similar to the page you would open on Kickstarter or similar crowdfunding platforms.

- Your backers will be sending BTC or ETH to your address, when in return they will be receiving tokens issued by you.

- You, as the founder/owner of the project can utilize the received BTC or ETH to pay your staff, or sell the received cryptocurrency for fiat currency on a cryptocurrency exchange (which btw might not be “cool” in the words of the blockchain community but hey – no judgement).

So, fairly simple and no coding required. And yes, I hear your question of what backers would do with their tokens, so stay with me.

In 2015, I wrote a piece called “IPO for All or How to Create Your Own Currency” where I pointed out that if you happen to live in the 21st century, your company’s stock should be worth money, and you should be able to turn around and sell it. In other words, every operational (and ethical) venture, regardless of its size, industry and even growth rate (that is probably not high enough to command market multiples satisfying VCs’ appetites and their “hit-or-miss” business model), should have an opportunity to pitch its investment offerings to all types of potential investors (including avid customers) and go public so that its stock eventually could become a currency for its founding team and employees.

That time I was talking about mini-IPOs, or so called Reg A+ , following the signing of the JOBS Act (a total of $396M was raised through the end of February 2017).

Fast forward to the present I wonder now – can ICOs also serve a purpose similar to that of equity crowdfunding otherwise known as Regulation Crowdfunding (you can learn more about equity crowdfunding types in my piece HERE)? But the most fundamental question remains open: what makes your tokens a currency? David Koepsell says;

“Here’s what I think about token sales: if the token is used as a medium of exchange outside of speculation, then it is a currency. If a token is bought and sold as a pure market speculation, then its function is different, not a currency.”

Has anyone made any profits out of investing in ICOs?

“Sure, I do know some who bought Golem during ICO and sold for hefty profits,” he adds. “If you buy large volumes of tokens during an ICO, chances are you are speculating that you could make a mint.” (Learn more about Golem HERE).

OK then. What else do we need to know?

Important features of ICOs: don’t try this at home

Steven Wright, a legendary comedian and an Oscar-winning film producer once said;

“There’s a fine line between fishing and just standing on the shore like an idiot.”

So, while it is hard to find common patterns in the current “wild west” world of ICOs, there are some features that might help you decide if you would like to join this club, password required.

- The typical project is heavily rooted in blockchain and has a founding team with a very strong background in cryptocurrencies or decentralization. So, if you are thinking of raising funds for a pizza restaurant that’s not a good idea – well, at least not yet. (When I shared the “pizza place story” I had to agree with David Orban as he reminded me that in the early 90s with the rise of Internet, the owners of restaurants never thought of getting websites for their “low-tech” businesses).

- Most ICOs have several white papers, but the language of pitching material you will see on the webpages is very “loose”, with little or no risks addressed and disclaimers suggesting that tokens are “not a security and not an investment”.

- Self-identification is welcomed but not needed – neither from the side of backers nor from the side of the fundraisers.

- The prices can change quickly so early investors are not expecting more favorable valuations by default vs later investors as might be found in a typical fundraising deal.

- There are targets, set automatically, for minimum and maximum amounts to be raised. If the minimum is not achieved, the backers will be refunded and the project will be closed; when the maximum is reached, no more tokens will be issued.

- Liquidity is believed to be achieved right after ICO when the tokens will be listed on cryptocurrency exchanges – which have neither listing requirements nor any obligations of conducting due diligence on coins they are listing.

- Based on my research and interviews, the cost of ICO can run from $100K (which typically would cover only the legal bills) to $250K and higher.

If you are still reading you must be onto something

Let’s recap and add some important points:

- With ICOs, a startup with a blockchain technology issues its own cryptocurrency that is believed and perceived by its followers, users and customers as “money” which can be used as a medium of exchange.

- Therefore, it is a startup’s network who will assign an economic value of the founder’s interest in his own venture given everyone’s stake (remember – not equity’s stake!) and the law of supply and demand.

- And it is also the startup network and the customer base who will be influencing further value fluctuations.

- This is quite a different animal if you think about the traditional VC model where a group of financiers negotiate a valuation of the company with a founding team, based on their own sense of rightness and a financial model presented beautify in an Excel spreadsheet.

- Since crypto-markets are typically very liquid markets we might witness the rise of speculators who could easily pump-and-dump.

- The system is self-regulated so what can go wrong here? Everything – just like in any heavily regulated system (hashtag: human nature).

So, what happens now?

So, what happens now?

When you are looking at the current state of ICOs, in this new wild frontier of finance, you might want to point an unsustainable system which is overcrowded by bad actors, immature players and simply random people who should not be in the business of building companies in the first place.

But let’s step back and remember that any emerging complex system has a non-linear expansion, volatility is part of the progress and historically bubbles are the painful tools which clean out the system and make it stronger without killing it in. Reflect on the dotcom bubble which didn’t kill the Internet but eventually took it to a whole new level. Remember a well-known mantra: the more things change – the more things stay the same.

In fact, I can speculate that to date the most profits have been made via investing in startups designing financial instruments – quite similar to why Wall Street loves companies designing financial products or, to put it simply, when “finance invests in finance”. So, my metaphysical question – can ICO, in its developed and upgraded form in the near future, become an instrument that would actually incentivize real businesses, with real customers and a social mission?

I have yet to find an answer to this one, but if anything, it is clear we are in the midst of a drastic change in the financing world when blockchain technology has brought an entirely new dimension formed by the “tokenization of the economic activities,” in the words of David Orban.

For what it’s worth, we already see a rise of good ventures – the Amazon type – or impactful ventures like, for example TheSunExchange.com (where you can purchase solar cells if you so wish).

We also observe the change in governments’ attitudes all over the world as they suddenly pay close attention to what used to be a forbidden subject. At no time in human history have we had the debt levels we currently have. And – with interest rates that are already close to zero, the Holy Grail of monetary policy – the capacity to stimulate economic activity via lowering interest rates – is becoming irrelevant. To put it simply, the system cannot work the way it was designed to work and is more and more perceived to be unstable (remember my passage about faith?).

Do you hear that cracking sound too? What now?

Well, for better or worse, what we are witnessing is a historical phenomenon where on the one hand, companies are becoming as powerful as national governments serving a massive number of people who are digitally and globally connected and very easy to reach, influence and deploy.

On other hand, there’s the rise of a technology which is capable of serving as a medium for value transference while completely bypassing central banks in a completely self-regulated system – which I bet will prove the truth in Plato’s famed quote that;

“Good people do not need laws to tell them to act responsibly, while bad people will find a way around the laws.”

The future of finance has already arrived – we just need to open our eyes – and minds – to see it through our modern, screen-driven lives and…not get scared. Fundamentally, the wealth has been generated from abstract concepts for centuries so, let’s dare not to judge but instead to think, educate ourselves and understand.

*ICO will be one of the key alternative funding topics discussed at the World Funding Summit to be held Nov 17 and 18 at the Los Angeles Convention Center. For more details go to www.worldfundingsummit.com

*ICO will be one of the key alternative funding topics discussed at the World Funding Summit to be held Nov 17 and 18 at the Los Angeles Convention Center. For more details go to www.worldfundingsummit.com

Victoria Silchenko, Ph.D. is a leading alternative funding expert, an economist turned entrepreneur and educator, Founder & CEO of business consultancy Metropole Capital Group, Creator & Producer of the World Funding Summit and an Adjunct Professor on “Entrepreneurial Finance” @CLU. Dr. Silchenko currently serves on the Board of the Los Angeles Venture Association (LAVA) & California Stock Xchange. LinkedIn Twitter Facebook