Pointing to the recently published EY Fintech Adoption Index, Australia is doing a bit of chest pounding as their prominence in the Fintech sector rises. In a public release, FinTech Australia says Australia is now a world leader in Fintech adoption jumping ahead of other developed markets such as the US, Hong Kong and Singapore.

Pointing to the recently published EY Fintech Adoption Index, Australia is doing a bit of chest pounding as their prominence in the Fintech sector rises. In a public release, FinTech Australia says Australia is now a world leader in Fintech adoption jumping ahead of other developed markets such as the US, Hong Kong and Singapore.

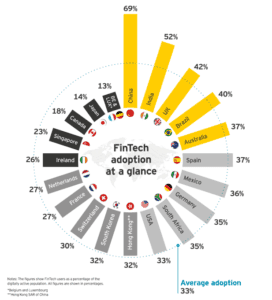

The EY FinTech Adoption Index shows that Australia is now ranked fifth highest out of the top 20 surveyed markets for Fintech consumer adoption. Specifically, the Index ranked the top five as follows.

- China

- UK

- India

- Brazil

- Australia

FinTech Australia reports that Australia’s improved ranking is based on the fact that 37% of Australia’s digitally active population are now Fintech users, compared to 13% in 2015.

FinTech Australia says it has leap-frogged Hong Kong, Singapore and the United States in the ranking table and also stands ahead of other markets such as South Korea, France, Canada and Japan.

Additionally, between 2015 to 2017, the number of Australians who said they would prefer to use a traditional financial services provider dropped from 23% to 10%.

FinTech Australia states that approximately 400 Fintech companies operate in the country, with 72 per cent of these companies supplying services to businesses and 54 per cent supplying services to consumers.

FinTech Australia states that approximately 400 Fintech companies operate in the country, with 72 per cent of these companies supplying services to businesses and 54 per cent supplying services to consumers.

“This index shows that Fintechs are increasingly providing great services and real choice for Australians when it comes to financial services,” said FinTech Australia president Simon Cant. “Fintech is no longer just an industry with future potential – it is now an industry which is delivering great on-the-ground outcomes and becoming the first choice for financial services for many Australians. We hope that this index result attracts the attention of domestic and international Fintech investors as it underscores the opportunity for investors in this market to back Fintechs that can rapidly attract material market share.”

Cant said the index also reinforced the urgency for ongoing government regulatory support, including the creation of an open financial data framework and expanding the scope of Australia’s regulatory sandbox.

“The result also illustrates the strong credentials of Australia as a great international launch and expansion market for Fintech products, due to its early adoption of new technology and ideas.”

Australian Treasurer Scott Morrison commented on the report;

Australian Treasurer Scott Morrison commented on the report;

“I welcome this result showing Australia is becoming one of the highest adopters of FinTech in the world. Fintech adoption is good for the economy and good for Australian consumers. It also helps reduce tax avoidance and criminal activity, which levels the playing field for everyone. These results shows the Turnbull Government’s plan to make Australia a global FinTech centre is working. It will drive better outcomes for customers and businesses, making financial services cheaper, providing new and easier ways to obtain financing, faster services and more options.”

EY FinTech advisor Meredith Angwin chimed in clarifying that the Adoption Index clearly shows is that Fintech is gaining widespread traction, both locally and globally, and has achieved the early stages of mass adoption in most countries.

“In our previous report, we predicted local FinTech adoption rates were set to double and that has certainly been the case, with usage among digitally active Australians rising from 13% in 2015 to 37% in our latest survey. FinTech start-ups have been very successful in building on what they do best – using technology in novel ways and having a laser-like focus on the customer.”