What was previously a relatively innocuous industry sector, the financial technology (or “Fintech”) industry has exploded over the past few years.

With the litany of new Fintech startups and existing Fintech businesses, and even Fintech specific incubators and accelerators popping up, the Fintech revolution is clearly in full effect.

As with any fast growing industry however, the current laws are often ill-suited to cover the substantive issues and it takes time for regulatory bodies to catch up. This could not be truer for the Fintech industry which is currently experiencing significant regulatory growing pains.

What Is Fintech Exactly?

Fintech is a portmanteau (that’s your word of the day) for the term financial technology. Originally the Fintech title referred primarily to technology fostered by established financial institutions and trading organizations (e.g. ATMs, e-trade, etc.). Today however, depending on whom you talk to, the ever expanding Fintech term can be used to describe any technological innovation in, or related to, money or investment. The most commonly referenced subsectors of the Fintech industry today include:

- Marketplace/Peer-To-Peer (P2P) Online Lending Tech & Crowdfunding – Technology focused on connecting individuals and small businesses seeking funding (often those who cannot find funding under traditional options) with access to available funds.

- Mobile Payment Tech – Technology (particularly smartphone related) focused on creating new ways to allow consumers to use their money (e.g. make purchases, transfer money, etc.) without relying on cash, checks, or cards.

- Wealth Management Tech – Technology focused on creating new ways to allow consumers to invest their money and manage their investments; including investment selection, asset allocation, account aggregation, risk assessment and even automated investments based on the individual’s data and risk preference.

- Blockchain Tech (also referred to as “Distributed Ledger Tech” or “DLT”) – Technology focused on providing a secure method of conducting near real-time transfers of digital assets (potentially without the need for an intermediary) and/or evidencing the authenticity and chain of title of digital assets.

Participants in the new market sectors above have experienced astronomical growth over the last few years. As highlighted in a recent Forbes article, VBProfiles (San Francisco-based market intelligence platform, that tracks the Fintech sector) estimates that there are currently over 1,000 Fintech companies (startups and established companies) operating across the U.S., Europe, and the Asia-Pacific region which, together, represent over $105 billion in total funding and nearly $870 billion in estimated current value.

As if that wasn’t enough, we need to remember that this industry is literally still in its infancy and this is only the beginning.

According to VBProfiles, the main global hubs for Fintech revolution are the US, the UK and France. Domestically, California, New York and Illinois stand-out as the primary Fintech innovation hubs.

Increasing Regulatory Issues

The growing Fintech sector is presenting unique and significant legal, compliance, and practical challenges for both Fintech companies and traditional financial institutions, particularly here in the US.

Other global hubs like the UK and France have significantly modified, and in some instances thrown out and completely re-written, existing laws to better suit the needs and concerns of the growing Fintech industry.

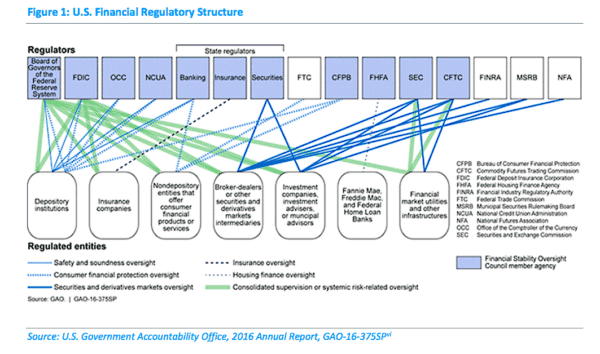

In the US however, we are not as lucky. Fintech companies often face a complex matrix of federal and state regulation with little to no guidance as to exactly which laws are applicable. To make matters worse, the majority of these laws are antiquated and do not translate well, if at all, into today’s internet and mobile based society leaving their application open to significant interpretation.

In fact, while there has been some recent state and federal initiatives to craft Fintech specific regulations, much of the current regulation concerning the Fintech industry is driven primarily by the interpretations of courts and financial regulators as to how preexisting, age-old, laws and regulations apply to today’s Fintech companies.

While not Fintech specific, there is currently a ton of federal and state regulation concerning financial institutions and intermediaries; including banks, investment vehicles and investment advisors.

In fact a good rule of thumb, which many Fintech entrepreneurs fail to realize, is that if a company’s business relates to the movement of money in one way or another there is almost certainly some federal and/or state regulation in effect which the company should be complying with.

One of the biggest issues for Fintech entrepreneurs and companies today is determining which of the cavalcade of existing state and federal rules and regulations they should be complying with. The process becomes even more convoluted when, as often happens, the Fintech company doesn’t fit squarely into a particular financial sector (e.g. a company is lending funds vs. selling debt securities). Without going into detail, as we will be here all day, let’s take a quick look at the issues a US Fintech company might deal with in navigating the current financial regulatory schemes.

To determine which laws a company would be subject, the company would first need to narrowly define what financial services and products it actually provides, or intends to provide, and where it intends to operate. This exercise is easier said than done and is often taken too lightly by companies. All to often the difference between falling under one regulatory scheme and a completely different one will hinge on a single product or service differentiation (e.g. a company is lending funds vs. selling debt securities). Let’s assume for the sake of example that our subject company is an Illinois company engaged in a business similar to SoFi (a Fintech company that helps users refinance existing student and other loans).

Looking first to the state level, each state will have its own rules and regulations regarding the selling or offering of financial related products and/or services. Most often those regulations come first in the form of required registration with one or more local regulatory entities.

For example, if a company’s business involves the lending or money, and/or the brokering of lending transactions, that company will almost certainly need to be registered and licensed with the applicable state agency(ies).

Accordingly, in keeping with the example, our subject company would need to be registered and licensed with the Illinois Division of Financial Institutions and, quite possibly, with one or more other governing Illinois agencies depending on the specifics of its business. However, the company’s regulatory compliance doesn’t stop there, not in the least.

First, the particular products being offered by the company will almost always subject it to additional laws and regulations. Again, continuing with the example, the company would effectively be offering a “loan” product and would then be subject to a slew of local laws including usury (i.e. interest rate), predatory lending and consumer protection laws.

Second, what has been discussed so far relates only to the initial regulatory compliance. Each company will need to deal with significant ongoing compliance disclosures to, and oversight by, governing state bodies.

Finally, if our subject company intends to do business in any state other than Illinois, it would also be subject to such other state’s unique laws and would need to run through the entire exercise again. As you can guess, when doing business in multiple states, initial and ongoing regulatory compliance can be a time-consuming and very complex task.

Finally, if our subject company intends to do business in any state other than Illinois, it would also be subject to such other state’s unique laws and would need to run through the entire exercise again. As you can guess, when doing business in multiple states, initial and ongoing regulatory compliance can be a time-consuming and very complex task.

Assuming our example company can navigate through the state level regulatory issues, they will undoubtedly be subject to one or more federal regulations, including (but certainly not limited to):

- the Truth in Lending Act (TILA; 15 U.S.C. § 1601, et seq.), the Fair Credit Billing Act (FCBA; enacted as an amendment to TILA), the Fair Credit Reporting Act (FCRA; 15 U.S.C. § 1681, et seq.), the Fair Debt Collection Practices Act (FDCPA; 15 U.S.C. § 1692, et. seq.), the Equal Credit Opportunity Act (15 U.S.C. § 1691, et seq.), and other applicable federal consumer protection laws;

- the Bank Secrecy Act of 1970 (BSA; 31 U.S.C. § 5311, et seq.), the Patriot Act (H.R. 3162, 107th Cong. (2001)) and related “anti-money laundering” (AML) and “know your customer” (KYC) statutes and requirements;

- the Dodd–Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank; Pub.L. 111–203, H.R. 4173), the Electronic Fund Transfer Act (EFTA; 15 U.S.C. § 1693, et seq.), the Bank Service Company Act (BSCA; 12 § U.S.C. 1861, et seq.), and other applicable banking and financial institution related laws and regulations; and

- the Securities Act of 1933 (15 U.S.C. § 77a, et seq.), the Securities Act of 1934 (15 U.S.C. § 78a, et seq.), the Investment Company Act of 1940 (15 U.S.C. § 80-1, et seq.), the Investment Adviser Act (15 U.S.C. § 80b-1, et seq.), and other applicable securities laws.

To put things into prospective, the above cited regulations, which is by no means an exhaustive list, alone represent thousands of pages of information; let alone the related case law and regulatory guidance issued in connection with each over the years.

To top it all off, trying to apply many of these outdated laws to new Fintech products and services results in the textbook definition of trying to put a round peg in a square hole. It’s enough to make a seasoned attorney’s head spin, let alone a layman.

Is Federal Preemption The Solution?

With the haphazard framework of existing regulations in mind, the Office of the Comptroller of the Currency (OCC) has decided to take the first step to create a uniform, nationwide set of standards for Fintech companies. What started as a request for comments on regulatory standards by the OCC last March has since turned into a formal proposal which is poised to upend the entire Fintech industry.

With the haphazard framework of existing regulations in mind, the Office of the Comptroller of the Currency (OCC) has decided to take the first step to create a uniform, nationwide set of standards for Fintech companies. What started as a request for comments on regulatory standards by the OCC last March has since turned into a formal proposal which is poised to upend the entire Fintech industry.

The OCC proposal, which was made in December of last year by Thomas J. Curry, the Comptroller of the Currency, is aimed at establishing a new program which would allow Fintech companies to be able to apply for charters as “special purpose national banks.”

This 17 page proposal both provides for the general framework as to how the special purpose charter would work and explores the importance of fostering “responsible innovation.” The original OCC proposal was further supplemented by the release of a licensing manual supplement by the OCC in March of this year.

While not being overly detailed, the new supplement does offer additional information on just how the OCC intends to apply existing national bank licensing standards and requirements to Fintech companies seeking registration under the new program. In particular, the supplement provides that registered Fintech companies would be subject to, among other things:

- bank-like regulation and oversight (including compliance and risk management controls and ratings);

- varying supervision standards commensurate with the size and complexity of the subject Fintech company; and

- the same minimum capital requirements as traditional banks (although the OCC will have the power to establish special minimum capital requirements, on a case-by-case basis, based on specific risk factors).

While optional, registration under this proposed program would provide the subject Fintech Company with several advantages, the most significant of which would be federal preemption.

A Fintech company registered under this new program would be able to benefit from the same federal law preemption of state laws as national banks (including those requiring local registration, among others), significantly limiting the authority and oversight state agencies would have on the company. Put another way, the whole section above discussing direct state regulation of Fintech entities would become essentially moot.

On the other side of the coin, under this new program a registered Fintech company would be subject to the same extensive federal regulation (including regulatory agency supervision as well as reporting and examination requirements) as national banks. These would include compliance with the majority, if not all, of the federal regulations discussed above; even if the application of such regulations to the particular Fintech company may have been subject to interpretation had the company not registered under this new OCC program.

On the other side of the coin, under this new program a registered Fintech company would be subject to the same extensive federal regulation (including regulatory agency supervision as well as reporting and examination requirements) as national banks. These would include compliance with the majority, if not all, of the federal regulations discussed above; even if the application of such regulations to the particular Fintech company may have been subject to interpretation had the company not registered under this new OCC program.

Taking that into account, at least the registered Fintech company would know exactly what laws they would be subject to, even if extensive. As they say, often the devil you know is better than the one you don’t.

In theory, the OCC’s proposal has a lot of merit. While the Fintech industry is relatively young, it is apparent that this industry is quickly changing and defining how many people will save, exchange and invest their money well into the future. Accordingly, this industry needs guidelines and proper regulation to ensure proper consumer protection and existing laws are simply ill-suited to do so.

Moreover, as noted above, other global Fintech hubs like the UK and France have taken measures to substantively revise existing laws, or throw them out all together in favor of new ones, in order to meet the unique needs of this growing financial sector so why shouldn’t the US follow suit? However, what should have been viewed as a noble first step in the right direction was instead met with a slew of objection from multiple sources.

As you might imagine, this proposal is not sitting well with state regulatory authorities. Just like with many other attempts at federal preemption (cough … Reg +), state regulators are currently up in arms about the OCC’s proposal and its attempt to push federal regulation into areas which have been traditionally regulated by the individual states.

As always, the states believe they are in the best position to protect local consumers and the federal government should stay in its lane. Certain lawmakers have also expressed concern about the OCC’s proposal.

In a recent comment letter sent to the OCC by Representative Jeb Hensarling, the House Financial Services Committee Chairman, and 33 other House Republicans, the OCC was urged not to rush to push its proposal without further opportunity for extensive comment. Even certain Fintech supporting organizations have raised concerns that the proposal would put too much regulation and cost on growing Fintech companies, stifling innovation.

In a recent comment letter sent to the OCC by Representative Jeb Hensarling, the House Financial Services Committee Chairman, and 33 other House Republicans, the OCC was urged not to rush to push its proposal without further opportunity for extensive comment. Even certain Fintech supporting organizations have raised concerns that the proposal would put too much regulation and cost on growing Fintech companies, stifling innovation.

The OCC proposal has a long way to go before becoming law but, given the current hodgepodge regulatory framework affecting Fintech companies today, I believe it is absolutely the right way to go.

Federal preemption is always vehemently contested by state regulators and in some instances the arguments might be just. However, in this instance I do not see the justification for the opposition.

What the OCC is proposing is optional, and not mandatory, and it will go a long way in clearing up the current maze of state regulations Fintech companies might be subject. Fintech companies need a clear path to regulatory compliance and the OCC proposal can help create that path.

Conclusion

The regulatory landscape surrounding Fintech products and services will continue to change significantly as exiting laws are interpreted in new ways, and more importantly new laws are enacted, to deal with the unique concerns of the Fintech industry. If there is one take-away from this post it’s that it is absolutely imperative for Fintech companies to engage experienced counsel to help Sherpa them through this ever-changing regulatory landscape. Financial regulatory compliance is not for the faint of heart, or for laymen for that matter, and there are tons of landmines waiting for the unwary.

Anthony Zeoli is a Senior Contributor for Crowdfund Insider. He is a Partner at the law firm of Freeborn in the Corporate Practice Group. He is an experienced transactional attorney with a national practice specializing in the areas of securities, commercial finance, real estate and general corporate law. Anthony recently drafted the bill to allow for an intrastate crowdfunding exemption in Illinois.

Anthony Zeoli is a Senior Contributor for Crowdfund Insider. He is a Partner at the law firm of Freeborn in the Corporate Practice Group. He is an experienced transactional attorney with a national practice specializing in the areas of securities, commercial finance, real estate and general corporate law. Anthony recently drafted the bill to allow for an intrastate crowdfunding exemption in Illinois.