The Financial Stability Board (FSB) is an international body that monitors and makes recommendations about the global financial system. Based in Switzerland, the FSB was established in 2009, in part, a response to the global financial crisis that shocked the world. Ostensibly the FSB is designed to promote financial stability and guard against system risk.

Shadow banking is the traditional term for any banking service not handled by a bank. The term is a bit charged with a negative connotation at least in the world of alternative finance.

The FSB defines shadow banking system as “credit intermediation involving entities and activities (fully or partially) outside the regular banking system” or non-bank credit intermediation in short. Appropriately conducted, the FSB believes they provides a valuable alternative to bank funding that supports real economic activity. But the FSB also states that some non-bank entities may operate on a large scale that create bank like risks to financial stability. The report states that the inclusion of non-bank financial entities does not constitute a judgement that policy measures applied to address the financial stability risks from shadow banking of these entities and activities are inadequate or ineffective. It is based more on the possibility that in times of stress there is the possibility of risk to these sectors.

The Global Shadow Banking Monitoring Report is the results of the FSB’s sixth annual monitoring exercise to assess global trends and risks in the shadow banking system. It reflects data up to the end of 2015.

According to the authors of the FSB document, the main findings are as follows:

- The activity-based, narrow measure of shadow banking was $34 trillion in 2015, increasing by 3.2% compared to the prior year, and equivalent to 13% of total financial system assets and 70% of GDP of these jurisdictions.

- Credit intermediation associated with collective investment vehicles (CIVs) comprised 65% of the narrow measure of shadow banking and has grown by around 10% on average over the past four years. The considerable growth of CIVs in recent years has been accompanied by liquidity and maturity transformation, and in the case of jurisdictions that reported hedge funds, relatively high level of leverage.

- Non-bank financial entities engaging in loan provision that are dependent on short-term funding or secured funding of client assets, such as finance companies, represent 8% of the narrow measure, and grew by 2.5% in 2015. In at least some jurisdictions, finance companies tended to have relatively high leverage and maturity transformation, which makes them relatively more susceptible to rollover risk during periods of market stress.

- In 2015, the wider aggregate comprising “Other Financial Intermediaries” (OFIs) in 21 jurisdictions and the euro area grew to $92 trillion, from $89 trillion in 2014. OFIs grew quicker than GDP in most jurisdictions, particularly in emerging market economies.

It is the OFI category that may be a “conservative proxy ” for the size of the shadow banking sector.

OFIs in the 21+EA-group continued on an upward trend, increasing for the seventh consecutive year by $3.8 trillion in 2015 to reach $92 trillion.

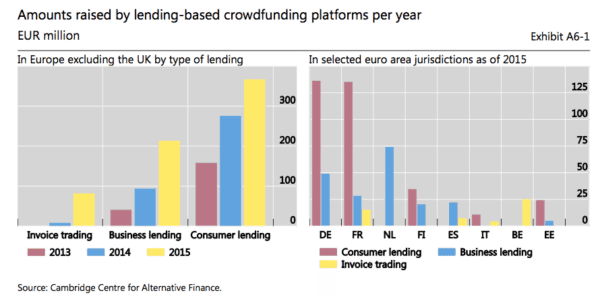

There is an annex that reviews lending based crowdfunding which is equivalent to P2P/Marketplace lending – the largest sector of the crowdfunding market. The report states;

“The market for technology-enabled financing has been expanding rapidly in recent years, in particular for lending-based crowdfunding, which is a means for raising debt-funding from investors via an internet-based platform. The low operational costs of crowdfunding platforms benefit both borrowers and investors. However, since the business models of some of these platforms include the provision of loans or engagement in credit facilitation outside the regulated banking sector, these activities should be carefully monitored from a financial stability perspective, including their involvement in shadow banking.”

“In the EU, the volume of lending raised through these crowdfunding platforms has on average increased by 60% every year since 2013 with nearly €12 billion lent between 2013 and 2016, with the market much larger in the UK compared to the euro area. More than 50 crowdfunding platforms remaining active have been launched each year since 2013. However, while many new platforms still enter the market and growth has been exceptional, the pace of expansion has slowed somewhat in 2016.”

One risk mentioned is an issue of “moral hazard” with a fee based model that provides an incentive to originate a growing number of loans.

While growing rapidly, the paper states the market (in Europe) is currently too small to be a risk for financial stability. Risks may evolve if sector growth continues but for the moment the FSB is taking a wait and watch approach.

The report is embedded below.

[scribd id=348806781 key=key-fQsQnVaZ3YkjMz5ythvs mode=scroll]