FINRA, or the “Financial Industry Regulatory Authority”, is one of the most powerful financial regulators in the United States. It is also a private corporation that performs its duties as a “self-regulatory organization” (SRO). FINRA oversees the thousands of broker-dealers and other financial industry participants as it seeks to protect the public against fraud and poor operating practices. FINRA has the power to punish and assess fines when they deem it appropriate while working to educate investors and resolving securities disputes. Every broker-dealer in the US must be approved by FINRA. This holds true for the newest financial entities engaged in crowdfunding created by the JOBS Act of 2012. FINRA plays an incredibly important role as it researches and reviews potential transgressions while assuring a high degree of professionalism for investment industry participants. But recently FINRA has fallen under added scrutiny; as FINRA’s power and influence has increased – some industry participants and observers have begun to question its operational process.

FINRA was created by a marriage between its predecessor entities; the National Association of Securities Dealers (NASD) and the enforcement operations of the New York Stock Exchange (NYSE). The merging of the two entities was approved by the SEC back in 2007. Ostensibly, the combination reduced duplicated processes thus saving money across the board. At the time of the merger, James D. Cox, a Professor at Duke University who specializes in securities law, called the combination “the first shoe of many to drop in ultimately moving to a single regulator.”

FINRA was created by a marriage between its predecessor entities; the National Association of Securities Dealers (NASD) and the enforcement operations of the New York Stock Exchange (NYSE). The merging of the two entities was approved by the SEC back in 2007. Ostensibly, the combination reduced duplicated processes thus saving money across the board. At the time of the merger, James D. Cox, a Professor at Duke University who specializes in securities law, called the combination “the first shoe of many to drop in ultimately moving to a single regulator.”

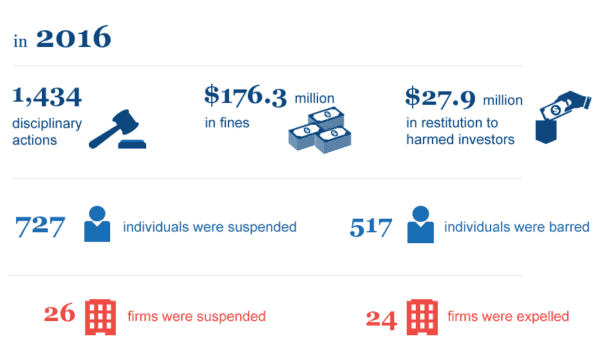

In 2016, FINRA reviewed 3,070 complaints, taking 1,434 disciplinary actions while assessing $176 million in fines and demanding $27.9 million in restitution in dealing with more than 3800 member firms. In 2015, FINRA had approximately 3,500 employees and a budget of about $1 billion. FINRA also had about $2 billion in cash and investments on its balance sheet. The SEC, in comparison, took 868 enforcement actions during 2016 – according to its last annual report. These actions included judgments and orders of more than $4 billion. The SEC’s total budget for the fiscal year totaled $1.6 billion.

A self-regulatory organization is supposed to be controlled by industry participants. In fact, FINRA is controlled by a majority of non-industry participants calling the SRO title into question. While the ultimate arbiter for securities violations is the Securities and Exchange Commission, for various reasons FINRA carries a substantial amount of the regulatory oversight burden. This operational characteristic has created a disconnect in transparency and accountability between a pseudo-government agency and Congress. While the SEC is required to report and provide updates on its activities to Congress in public hearings, FINRA holds no such requirement while acting as a de-facto enforcement agency. Complaints and criticisms have been percolating for years. I cannot count the number of times I have been engaged in conversations when professionals in the securities industry (or their attorneys) have complained about FINRA’s “unrestrained” power. Yet as soon as you ask for an on-the-record statement, the discussion stops cold. Fear of retribution without recourse is profound.

There are Two Sides to Accountability

In 2015, Hester Peirce, the Director of Financial Markets Working Group at the Mercatus Center at George Mason University, published a paper that highlighted why FINRA was “not self-regulation after all.” The fact that FINRA’s board of governors is not permitted to have a majority of industry members undermines its SRO claims. Concurrently, FINRA has “regulatory powers similar to those of the Securities and Exchange Commission” – minus the accountability other federal regulators must entertain. Peirce politely stated that reforms are needed for this regulator to make it accountable to the public – the very group FINRA is expected to protect.

In 2015, Hester Peirce, the Director of Financial Markets Working Group at the Mercatus Center at George Mason University, published a paper that highlighted why FINRA was “not self-regulation after all.” The fact that FINRA’s board of governors is not permitted to have a majority of industry members undermines its SRO claims. Concurrently, FINRA has “regulatory powers similar to those of the Securities and Exchange Commission” – minus the accountability other federal regulators must entertain. Peirce politely stated that reforms are needed for this regulator to make it accountable to the public – the very group FINRA is expected to protect.

Jumping forward to today, a more recent critique of FINRA has been published by David Burton, the Heritage Foundation’s Senior Fellow in economic policy.

Burton is well-known in the Halls of Congress. Burton is a prominent advocate on the behalf of small investors, small business, and securities law reform. His assessment of FINRA is damning. The FINRA “Backgrounder” opens stating:

Burton is well-known in the Halls of Congress. Burton is a prominent advocate on the behalf of small investors, small business, and securities law reform. His assessment of FINRA is damning. The FINRA “Backgrounder” opens stating:

“FINRA is a regulator of central importance to the functioning of US capital markets. It is neither a true self-regulatory organization nor a government agency. It is largely unaccountable to the industry or to the public. Due process, transparency, and regulatory review protections normally associated with regulators are not present, and its arbitration process is flawed. Reforms are necessary. FINRA itself, the SEC, and Congress should reform FINRA to improve its rule-making and arbitration process.”

Burton’s paper on FINRA (embedded below) is a worthwhile read.

Burton calls FINRA’s Constitutionality into question saying Congress must act and address lingering questions regarding due process and transparency. While noting that FINRA is incredibly important, he outlines several paths to institutional reform.

Burton calls FINRA’s Constitutionality into question saying Congress must act and address lingering questions regarding due process and transparency. While noting that FINRA is incredibly important, he outlines several paths to institutional reform.

Crowdfund Insider asked Burton how we got to this point where FINRA acts, effectively, as a government regulator without Congressional oversight?

“FINRA and its predecessor organizations assumed more regulatory authority over time and the SEC handed off more and more of its regulation of broker-dealers,” explained Burton. “The erosion of the “self” in self-regulatory began as early as 1975. But the most obvious break occurred with the demutualization of the NYSE and NASDAQ and the creation of FINRA.”

In Burton’s opinion, it is an open question whether FINRA’s current structure is a violation of Constitutional separation of powers principles. Regarding the SRO status, Burton said that although the industry has influence, a majority of its board must come from outside of the industry negating that title. One option considered by Burton would be to fold FINRA into the SEC. Alternatively, it could be restructured to become a true SRO once again.

Quoting several legal experts on SROs, Burton’s paper explains;

“industry professionals have strong incentives to police their own, since many of the costs of misbehavior are born by all members of the profession, while the benefits inure only to the misbehaving few. So long as the few do not control the regulatory process, self-regulation could in theory work as well or better than external regulation.”

Inquiring about the abuse of power complaints frequently heard, be they large or small, Burton stated;

“I have never encountered a situation where so many – most – were so afraid of regulatory retaliation by their regulator that they were unwilling to speak publicly about regulatory problems or testify before Congress. Many are even afraid to meet privately with Congressional staff for fear that the fact that they did so would get back to FINRA. That is an indication to me that something is seriously wrong with the regulatory culture at FINRA. It is my sincere hope that the new leadership at FINRA will improve matters.”

Recently there has been several executive changes at FINRA. At least initially, industry participants have greeted these changes with guarded hope.

Recently there has been several executive changes at FINRA. At least initially, industry participants have greeted these changes with guarded hope.

In December, it was announced that Brad Bennet, FINRA’s enforcement chief was planning to step down after nearly six years on the job. Bennet had been dogged by some industry complaints as being overzealous in pursuing minor infractions and assessing fines.

FINRA has also appointed a new CEO, Robert Cook, who has taken pains to better understand the criticism and perhaps chart a slightly altered path for the regulator. In fact, Cook’s first days in his new role at FINRA saw him engaged in a “listening tour” – a pointed departure from FINRA’s reputation in the past as being “tin-eared.”

Burton commented on Cook’s appointment and possibility for internal reform;

“FINRA’s new CEO, Robert Cook, has taken the right steps so far. He is engaging with FINRA members and the public and listening. I think it is fair to say that he understands that changes are necessary. So I am hopeful that significant positive changes will start soon. However, even if he has the best of intentions, it is not an easy undertaking and both Congress and the SEC must play a constructive role.”

Regardless of Cook’s intentions, it appears there is growing chatter of a need to reform FINRA’s status as a regulator without Congressional oversight. I would not be surprised if Congress added FINRA reform to its growing list of legislative tasks this coming year. Burton believes that FINRA’s current status, and lack of transparency, makes it unclear how well FINRA is discharging its core mission of preventing fraud and thus protecting investors. Much of the FINRA rule-making and disciplinary actions occur behind closed doors.

“There is bipartisan, bi-ideological concern about FINRA enforcement,” states Burton.

The Backgrounder on FINRA Reform is embedded below.