OTC Markets Group Inc. (OTCQX: OTCM), operator of financial markets for 10,000 U.S. and global securities, announced on Thursday its trading statistics and news highlights for 2016. The year’s highlights are the following:

Total dollar volume of OTCQX, OTCQB, and Pink securities was $192.9 billion compared to $199.8 billion in 2015.

Total dollar volume of OTCQX, OTCQB, and Pink securities was $192.9 billion compared to $199.8 billion in 2015.- Dollar volume of OTCQX, OTCQB and Pink companies that provide current information to investors was $190.2 billion, representing 99% of total dol lar volume across all markets and demonstrating continued progress in using data-driven standards to drive OTC issuer disclosure for investors and brokers.

- 44 companies graduated from the OTC markets to a national stock exchange, 28 of which came from the OTCQX and OTCQB markets.

- Elio Motors Inc. (OTCQX: ELIO) became the first company to raise capital and go public under Title IV of the JOBS Act, Regulation A+, when it joined OTCQX on February 19, 2016.

- OTCQX disclosure standards recognized by 16 states for Blue Sky manual exemptions; OTCQB recognized by 14 states.

- Introduced the Transfer Agent Verified Shares Program to improve the accuracy and timeliness of share information for brokers and investors in OTCQX, OTCQB, and Pink securities.

- Launched two new OTCQX indexes: the OTCQX Canada Index and the OTCQX Dividend Index.

- Continued to expand market data distribution network in addition to Interactive Brokers, IPC, and Thomson Reuters.

- The introduction of OTC Compliance Analytics Product to help broker-dealers and risk management teams more efficiently analyze and quantify trading in OTCQX, OTCQB, and Pink securities.

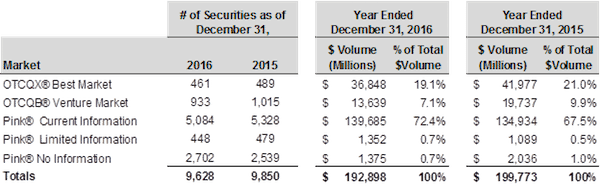

OTC Markets then explained the trading statistics by market for 2016 versus 2015:

“The total dollar volume of OTCQX, OTCQB and Pink securities declined 3.4% to $192.9 billion, reflecting lower trading volumes across all U.S. equity markets in 2016. OTCQX securities traded $36.8 billion in 2016, representing 19.1% of total overall dollar volume during the year.”

The table below reveals the number of securities included in each market as of December 31, 2016, and 2015 and the total dollar volume traded in each market during 2016 and 2015.

Also in 2016, OTC Markets confirmed that the increased standards and data availability continued to improve quality:

“Increased OTCQX and OTCQB market standards combined with growing recognition of our market designations and company information by investors, broker-dealers and market distributors and the deployment of new tools such as the OTC Compliance Data File continued to improve the transparency and quality of the OTC markets in 2016. OTCQX, OTCQB and Pink Current Information securities that provide adequate current information to investors traded $190.2 billion in 2016, representing 98.6% of total dollar volume. This compares to $196.6 billion in dollar volume in 2015, representing 98.4% of total dollar volume, and $224 billion in 2014, representing 93.9%. As of December 31, 2016, there were 6,478 securities traded on the OTCQX, OTCQB and Pink Current Information market, representing 67.3% of all OTC-traded securities.”

OTC Markets noted that in comparison investors have significantly reduced their trading in securities of OTC Pink No Information companies, which provide no disclosure to investors and are clearly labeled with a “Stop” sign. These securities traded $1.38 billion in 2016, representing 0.7% of total dollar volume, compared to $2.04 billion and 1.0% in 2015 and $12.4 billion and 5.2% in 2014.

“OTC Markets Group continued to outperform other leading global small company markets in terms of the number of graduates to a stock exchange in 2016. Forty-four companies graduated from the OTCQX, OTCQB and Pink markets to a national securities exchange in 2016, 28 of which came from the OTCQX and OTCQB markets. In comparison, 16 companies graduated from Canada’s TSX Venture Exchange to the Toronto Stock Exchange in 2016 and five companies graduated from London’s AIM market to the London Stock Exchange.”

Currently, 16 states recognize the OTCQX market for state Blue Sky manual exemptions: Alaska, Arkansas, Colorado, Georgia, Iowa, Kansas, Mississippi, Nebraska, New Jersey, New Mexico, Rhode Island, South Dakota, Vermont, Washington, Wisconsin, and Wyoming. All states with the exception of Kansas and Vermont also recognize the OTCQB Venture Market. The company added:

“OTC Markets Group is actively working with states that maintain a Blue Sky manual exemption to inform them of the easily accessible current disclosure available for investors on OTCQX and OTCQB securities at [OTC’s website[. The Company is committed to working with the North American Securities Administrators Association (NASAA) and the remaining states to determine how best to qualify OTCQX and OTCQB traded securities based on their unique regulatory environment and financial standards.”