Moody’s has published a report on the marketplace lending industry stating that platforms are “steadily expanding credit to small and medium sized enterprises (SMEs) – but challenges remain. The authors are of the opinion that partnerships with traditional banks may ease the path forward for this segment of online lending.

Entitled “Online Marketplace Lending Partnerships Can Benefit Lenders and Small Businesses; Pitfalls Remain for A Nascent Industry.” Moody’s points to the partnership between OnDeck and JPM as indicative of the potential of online lenders working with banks. Banks may be able to provide a lower cost of acquisition for borrowers;

“Customer acquisition costs average about 25% of revenue at some of the largest small business MPLs, and finding a reliable and low-cost source of funding has also been a challenge for small business MPLs.”

Moody’s believes the new lending technology can help provide credit to SMEs while banks will benefit from access to the technology – including faster loan review – while expanding their relationships with customers.

The caveat to all of this is the looming risks of online lending and the list is challenging. Moody’s highlights model risk, regulatory risk, loan performance uncertainty and, yes, risk from banks that are going it alone. With Goldman Sachs poised to enter the market in weeks, existing MPLs will have additional competition.

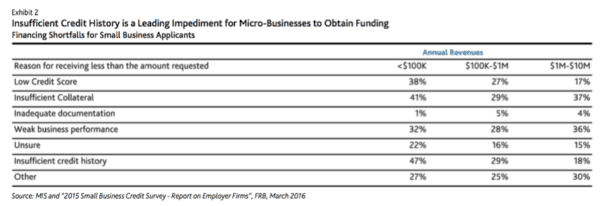

Overall, Moody’s advocates on behalf of the service provided by online lenders and the demand from SMEs. Frequently these borrowers have limited credit histories and may not be acceptable to bank lending requirements. Online lending can provide the much-needed credit. Micro-businesses are even more constrained and in need of online lending;

“Insufficient credit history is a leading impediment to obtaining funding for micro-businesses, and drives a larger proportion of such borrowers to small business MPLs relative to larger firms … roughly 47% of micro-businesses with less than $100K in revenues and 29% of micro-businesses with $100K-$1 million in revenues cited “insufficient credit history” as the reason for why they received less funding than requested. “Insufficient collateral” is the next leading cause. Unlike micro-businesses, “insufficient credit history” is not a leading reason cited by firms with more than $1M in revenues, which are generally more mature and have had time to establish a credit history.”

Online lending took a serious hit in the first half of 2016. The stumbling economy and the unexpected departure of former Lending Club CEO has generated profound industry anxiety. Online lenders have been scrambling for funding channels ever since.

The report, embedded below, is recommended reading.

[scribd id=322668581 key=key-2vu5qybg61IPRpfupH6f mode=scroll]