Last week the Payments Systems Regulator (PSR) announced that reform is needed in the UK payments sector to improve competition and better serve consumers. The announcement was made by the one-year-old agency following a report on payments released by the PSR. The PSR stated that there is no effective competition for the provision of UK payments infrastructure for the dominant payment systems.

Last week the Payments Systems Regulator (PSR) announced that reform is needed in the UK payments sector to improve competition and better serve consumers. The announcement was made by the one-year-old agency following a report on payments released by the PSR. The PSR stated that there is no effective competition for the provision of UK payments infrastructure for the dominant payment systems.

Hannah Nixon, Managing Director of the PSR, explained that the UK needed to “future-proof” the UK payment system to as remain at the forefront of innovation. By fostering an environment where new entrants are not subdued by wrong sized regulation and challengers can emerge, consumers benefit.

Hannah Nixon, Managing Director of the PSR, explained that the UK needed to “future-proof” the UK payment system to as remain at the forefront of innovation. By fostering an environment where new entrants are not subdued by wrong sized regulation and challengers can emerge, consumers benefit.

“As it stands, the current system is not adequate and we need to see a change. There is not one single area of concern, but a series of issues that are entwined and require a holistic approach in order to see them resolved. The remedies we are considering are packaged to achieve just that.”

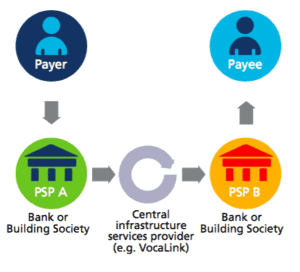

The PSR is currently consulting on a series of possible changes to expedite sector reform. These possible reforms include adopting a common international messaging standard to encourage new entrants and creating a competitive procurement process that addresses consumer needs. The PSR has also identified that common ownership and control of both the payment systems and the infrastructure provider as a key concern. The current market is dominated by a few large banks that also control VocaLink – the single infrastructure provider that the operators use to process payments. The PSR is proposing that the four largest banks that have common control of the payment system operators and the infrastructure provider should sell all or part of their stakes in VocaLink, in order to open up the market and allow for more effective competition and innovation.

“At present, common ownership and control remains a key issue. However, the recent news that MasterCard intends to buy VocaLink could address the issues we have identified,” stated Nixon. “It will be for the relevant authority to consider the effects of this merger under merger control law, but the fact that discussions are taking place about ownership, and changes are being made, is an encouraging sign. In the meantime, we must not lose sight of the other issues that are causing concern. The problem runs deeper than just the ownership of the infrastructure provider and we will want to see further changes in the market if competition is to be effective.”

The UK Payment systems are a vital part of the financial system and they are huge. During 2015, interbank payment systems processed over £74 trillion worth of payments, or the equivalent of 42,000 payments per minute. This includes credit cards, direct debit, contactless cards, apps and everything in between for both large and small transfers. As the world embraces a cashless exisistence digital currency wins the day. While the banks that control payments may not be pleased their oligopoly structure is being questioned, the PSR was tasked to encourage innovation and competition and ossified operations rarely seek dramatic change.

Nixon added;

“The work being undertaken across the industry should not be looked at in isolation …ultimately [this will] support the industry’s drive to create and innovate in the best interests of the consumer.”

Comments are being accepted on the proposal until September 22, 2016. Both the Fact Sheet (abbreviated version) and the full document are embedded below.

[scribd id=319816887 key=key-kTq0MLR50cxTjmMEKRJo mode=scroll]

[scribd id=319816975 key=key-Z7npRIkgvA8ELn1WGRWq mode=scroll]