They say that there is no such thing as bad press but I am not so sure that I agree with that statement. While this may be the case for the Kardashians, I don’t think the same holds true for the crowdfunding/P2P lending industries. In fact, based on some of the recent articles I have read, the press’ often lack of understanding might be doing more harm than good in terms of helping the general public understand what these industries are and how they can be useful. To help clarify things, Kiran Lingam (general counsel of SeedInvest) and I put together an Infographic analyzing the various existing capital options.

They say that there is no such thing as bad press but I am not so sure that I agree with that statement. While this may be the case for the Kardashians, I don’t think the same holds true for the crowdfunding/P2P lending industries. In fact, based on some of the recent articles I have read, the press’ often lack of understanding might be doing more harm than good in terms of helping the general public understand what these industries are and how they can be useful. To help clarify things, Kiran Lingam (general counsel of SeedInvest) and I put together an Infographic analyzing the various existing capital options.

Don’t get me wrong. I am truly happy that over the last year the mainstream media has really taken notice of the crowdfunding/P2P lending industries and their potential benefits to businesses and investors. The problem comes in the fact that many authors (and others) seem to be looking at the capital options in terms of their weaknesses in relation to each other and fail to see how each could be useful given the right circumstances. For example, as the author of the Illinois Intrastate Crowdfunding Bill, I have received multiple calls from reporters lately asking basically the same question which is: “with the recent release of the new Regulation A+ is there even still a need for an intrastate exemption?” With a deep relaxing breath my response is usually something like: “well, let me ask you, do you think a company preparing to do an I.P.O. has the same capital needs as a company preparing to do a Kickstarter campaign?”

Even if you disagree with the usefulness of intrastate exemptions in general, you have to agree that that comparing Regulation A offerings with intrastate offerings makes no real sense. It’s like comparing apples and pineapples. Yes, they are both fruits, but that doesn’t necessarily mean you could (or should) use one in the place of the other (unless you like pineapple pie and/or apple upside-down cake of course). Compliance with Regulation A rules will be an expensive and time consuming process which should be undertaken mainly by companies in their mid to later growth stages. An intrastate offering on the other hand can be used by start-ups and early stage companies to help such companies get the funding the need to make it to the mid to later growth stages.

Even if you disagree with the usefulness of intrastate exemptions in general, you have to agree that that comparing Regulation A offerings with intrastate offerings makes no real sense. It’s like comparing apples and pineapples. Yes, they are both fruits, but that doesn’t necessarily mean you could (or should) use one in the place of the other (unless you like pineapple pie and/or apple upside-down cake of course). Compliance with Regulation A rules will be an expensive and time consuming process which should be undertaken mainly by companies in their mid to later growth stages. An intrastate offering on the other hand can be used by start-ups and early stage companies to help such companies get the funding the need to make it to the mid to later growth stages.

What I am trying to say is that, despite many uninformed recent articles that either lump all crowdfunding/P2P lending capital options together under one big “crowdfunding” umbrella, or focus on one option (e.g. Regulation A+) to illustrate the shortcomings of other options, each of the crowdfunding/P2P lending capital options needs to be looked at individually to understand its true potential benefits. There is no “golden” capital option and there never will. Each company’s situation is unique as is their capital needs. That being said, each of the current crowdfunding/P2P lending capital options CAN be useful depending on the needs of the specific company. Some capital options are primarily for seed stage companies (e.g. “Donation Based” crowdfunding), some are better suited for mid-sized companies (e.g. Regulation A+ offerings), while other still are best suited for later stage/exiting companies (e.g. traditional IPOs).

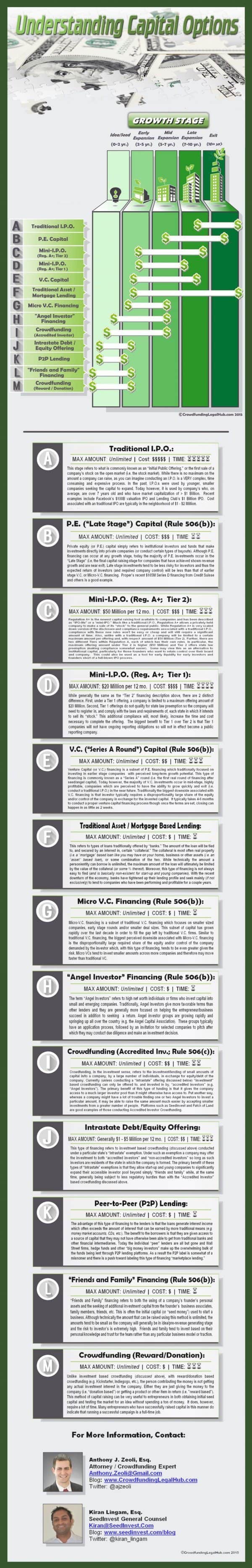

To better illustrate the potential benefits of the currently available crowdfunding/P2P lending (and other) capital options, Kiran and I put together the Infographic below. The intent of this infographic was to:

To better illustrate the potential benefits of the currently available crowdfunding/P2P lending (and other) capital options, Kiran and I put together the Infographic below. The intent of this infographic was to:

1) give a brief description of each of the various capital options;

2) provide a quick reference guide to the general amount of time and cost associated with each of these options; and

3) illustrate where, based on the growth stage of a company (and our opinion), each of the options might be most useful.

It should be clear from the Infographic that each of the capital options can have its “sweet spot” somewhere in the life of a growing company and can be useful given the needs and finances of the subject company. At the end of the day, there are numerous capital options available to today’s businesses, some of which have never existed before. Regardless of your particular feelings regarding one or more of the illustrated capital options the fact remains that each option can potentially give the subject company access to capital which it might not have otherwise have had access to … Certainly that can ONLY be looked at as a benefit.

Click to enlarge.

Anthony Zeoli is an experienced transactional attorney with a national practice. Specializing in the areas of securities, commercial finance, real estate and general corporate law, his clients range from individuals and small privately held businesses to multi-million dollar entities. Mr. Zeoli is also an industry-recognized crowdfunding and JOBS Act expert who, most recently, has drafted a bill to allow for an intrastate crowdfunding exemption in Illinois, a copy of which can be found on his website: IllinoisCrowdfundingNow.com. Anthony is also currently actively involved with the entrepreneurship program at the University of Illinois at Chicago as both a mentor and a student advisor and is an active advisory board member of the New York Distance Learning Association (NYDLA).

Anthony Zeoli is an experienced transactional attorney with a national practice. Specializing in the areas of securities, commercial finance, real estate and general corporate law, his clients range from individuals and small privately held businesses to multi-million dollar entities. Mr. Zeoli is also an industry-recognized crowdfunding and JOBS Act expert who, most recently, has drafted a bill to allow for an intrastate crowdfunding exemption in Illinois, a copy of which can be found on his website: IllinoisCrowdfundingNow.com. Anthony is also currently actively involved with the entrepreneurship program at the University of Illinois at Chicago as both a mentor and a student advisor and is an active advisory board member of the New York Distance Learning Association (NYDLA).

Kiran Lingam is General Counsel at equity crowdfunding platform SeedInvest. In his time before SeedInvest, Kiran worked as a corporate and securities attorney at the law firms of Jones Day LLP and DLA Piper LLP, where he served as outside legal counsel to venture capital and private equity funds, angel groups and over 30 technology startups. He has seen first-hand the struggles encountered by early stage entrepreneurs and believes strongly that many more startups would be successful with additional avenues for early stage capital. Since passage of the JOBS Act, Kiran has been an active speaker, writer and commentator on crowdfunding and the related legal issues. He is a Charter Member and Executive Team member of TiE (The Indus Entrepreneurs) and is an active member of a number of groups in the New York startup community. Kiran received a B.A. in Economics from Cornell University and a J.D., with honors, from the University of Georgia.

Kiran Lingam is General Counsel at equity crowdfunding platform SeedInvest. In his time before SeedInvest, Kiran worked as a corporate and securities attorney at the law firms of Jones Day LLP and DLA Piper LLP, where he served as outside legal counsel to venture capital and private equity funds, angel groups and over 30 technology startups. He has seen first-hand the struggles encountered by early stage entrepreneurs and believes strongly that many more startups would be successful with additional avenues for early stage capital. Since passage of the JOBS Act, Kiran has been an active speaker, writer and commentator on crowdfunding and the related legal issues. He is a Charter Member and Executive Team member of TiE (The Indus Entrepreneurs) and is an active member of a number of groups in the New York startup community. Kiran received a B.A. in Economics from Cornell University and a J.D., with honors, from the University of Georgia.